Trading Psychology, Success doesn’t just depend on technical analysis and fundamental research in the fast-paced world of financial markets. Also important is developing your trading psychology. Successful traders frequently differentiate from unsuccessful ones by their capacity to understand and manage their emotions. We will analyse the strategies used by profitable traders and go deep into the interesting field of trading psychology in this complete article. So seat tight and let’s go through the complicated world of “Trading Psychology.”

Table of Contents

Introduction

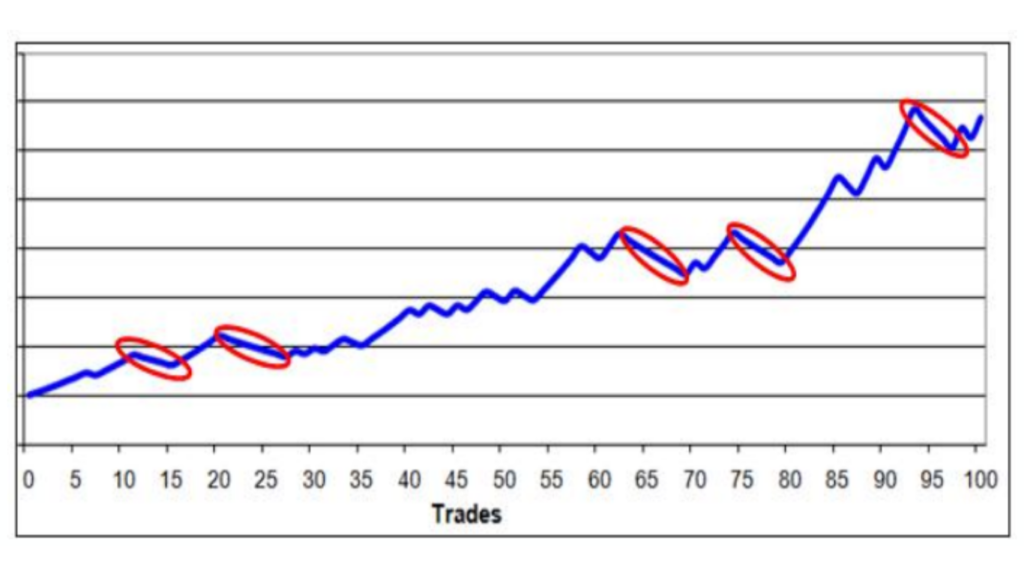

Many people consider trading as a game of minds in which the markets act as your enemies. However, you are frequently your own strongest opponent in this situation. Even the most experienced traders can make mistakes due to emotions, opinions, and psychological traps. One must first understand and master the psychological aspects of trading in order to become a successful trader.Trading psychology is almost 60% of success in trading journey.

What makes a successful Trader?

A good trader shows self-control, risk management, continuous learning, psychological wellness, flexibility, and a clear strategy. Their success is mostly due to their determination, understanding of the market, and patience. As per Above image showing that 60% is trading psychology ,remaing 30% is Position sizing and 10% only indicators or any other systems to success in the stock market. if you want to become good trader, please read this book MARKET WIZRDS – Top traders are interviewed.

Psychology is more Important Then Trading.

Successful traders differ from unsuccessful ones NOT because of the indicators or technical knowledge they have. Their approach to trading is what separates them from other traders.

- Even the most successful strategies and statistics won’t help you succeed if you have the wrong mindset regarding trading.

The ultimate goal of trading

- A lot of traders are always looking for the “holy grail of trading.” a unique secret strategy or indicator that can forecast the market and time. Is it a thing? No!

- The most effective theory or indicator is NOT the key to successful trading. The traders’ minds have the key to the secret.

Trading Psychology of winning Traders?

Discipline

- Trade according to with your defined entry and exit rules. Never rely on rumours, opinions, or emotions.

- Have the self-control to stay with your plan through wins and losses.

- Avoid listening to the opinions of ‘experts’ who can ‘predict’ the market based on insight or news.

Think Statistically

- A winning strategy will result in both wins and losses.

- There may be a string of losses (5–10 losses in a row).

- Avoid being grateful when you win or fearful when you lose.

- There is statistically insignificance for every trading result.

- A profitable trade could turn into a “loss.” Pay focus on following the rules rather than the result of each purchase.

- You will be profitable across a large number of trades as long as you have an edge (> 50% win) and your average win is greater than your average loss.

Patience

- Only trade when there is a good possibility of success.

- Do NOTHING when the rules state that it is not suitable for you to enter.

- Equally important as knowing what to do is understanding what not to do.

Instead of focusing on “Why,” pay attention to “What” is occurring?

- Trying to understand why the market is moving in a specific direction is a waste of time.

- Price changes are not influenced by current events (such as the Sensex or NIFTY rising in response to the debt ceiling resolution.

- Avoid from linking market trends to headlines.

- The answer to the question “What has happened in the market to cause this move?” has no relevance on trading success.

Do not predict the future.

- The future cannot be predicted since it is influenced by mass psychology.

- Avoid listening to experts or trying to predict the future yourself.

- Trade based on a trend reversal or the current trend.

- Forecasting the future affects our judgement and decreases our willingness to accept failure (ego).

Risk Management

- No trade can be considered win-proof. Always take minor risks with your money (between 1 and 3 percent), and only take on high-probability trades with pre-determined profit targets and stop losses.

High Level of Confidence

- Confidence to stick with your trading plan regardless successes and losses.

- The result of any given trade does not determine confidence.

- Having confidence comes from understanding that your trading strategy or plan has a positive expectation (edge).

A successful trade was one that followed with your predetermined trading plan.

You “broke” your own rules when you make the worst trade.

A successful trade could result in a profit or a loss.

Long-term success and repeated long-term profitability are ensured by good trade execution.

Even a losing trade can end up being profitable. While it could ‘feel good’ in the moment, it teaches negative trading behaviours over time and could result in poor outcomes.

Managing Your Emotions?

- When trading, you will experience a wide range of emotions related to the money in your account at risk, including greed, anxiety, doubt, hope, and excitement.

- Learn to think and act against our natural tendencies if you want to be a successful trader. Many of our emotional tendencies result in financial loss. We can break these tendencies if we are aware of them.

- Trading at a level of risk & capital where a few lost trades does not ‘hurt’ you emotionally is advised. ‘Pain threshold’ is a personal characteristic that determines this level of pain.

1.Greed

Greed may lead you to set profit targets excessively high and hold a position for an excessive amount of time. This could turn potential profitable trades into losing ones.

2.Fear

You can take quick profits out of fear.

Your strategy may no longer have a positive expectation if you take small profits (e.g. 0.5R) and don’t let winning trades benefit to the maximum level possible (such as 2R). Your winning trades’ gains might not be enough to offset your losing transactions’ losses.

Win 0.2R,

Win 0.8R,

Win 0.3R,

Win 0.4R

Loss -1R

Loss -1R

Loss -1R

Even with more wins than losses, your expectation is still negative.

3. Hope:

Winning & losing Streaks:

- The overall result of a trading journey won’t happen in a straight line.

- Don’t extrapolate results into the future by looking at the trade outcomes over a specific time period.

- Losing streaks shouldn’t discourage us, and winning streaks should not excite us.

- Losing and winning streaks will eventually “even out” each other.

- We will turn a profit if our wins and losses are distributed evenly over time.

- The “luck” factor has very little impact on long-term performance.

Common Trading Psychology Mistakes?

- After a few losses, jump into fresh deals to recover the losses as soon as possible.

- After several losses, you’re afraid to enter the next profitable trade.

- Stay in a losing trade in the vain hope that something will change.

- Focus on short-term results and lose perspective.

- Failure to maintain a constant risk per trade (R%) proportion.

- Altering trading systems/strategies frequently after suffering short-term losses.

- focusing on the account balance rather than following to the system

- Experience anxiety, tension, and lack of confidence as a result of losses.

- Blame others and look for outside causes for their difficulties.

- Having a desire to “get even” with a stock or the market after suffering a loss.

- Use trading strategies that don’t fit their personalities. Too frequently, after learning about someone else’s success, people feel forced to copy that person, whether out of jealousy or a lack of confidence.

Habits of Successful trades

- Always act when an honest, high-probability signal is present. They refuse to permit fear to impact their choices and restrict their trading.

- Accept responsibility, learn from mistakes, and move on. They skip over on failures.

- Accept losses as an essential part of the trading game.

- 4.Pay attention to following the trading system rather than the current account equity.

- Use statistics and maintain a long-term viewpoint.

- Pay attention to consistency. Follow the set entry and exit rules consistently.

- Show patience. Wait simply for opportunities with a high probability

Conclusion: Trading Psychology

Being a successful trader requires more than just a knowledge of charts and indicators; it also requires an understanding of yourself. We’ve discussed the complicated world of trading psychology and the techniques used by profitable traders. Keep in mind that understanding and mastering your own thinking is the first step towards trading success.

you can read this article as well.

- what is options trading?

- Future and options trading?

- How to select stocks for intraday

- Best indicator for option trading?

- What is Call option and Put Option?

- Best option Trading Books?

However, if you still have any questions about this topic, feel free to leave comments below.

3 Comments on “Trading Psychology of winning traders: Mastering the Mental Game 2023”