A risk management technique called position size calculator India helps traders and investors in deciding how much of their cash to allocate to each trade. Traders can manage their risk and stay away from overtrading by determining the size of their positions.

Traders and investors can calculate their proper position size with the help of a position size calculator India. The risk tolerance of the trader, the size of their account, and the volatility of the stock they are trading are often taken into account by these calculators.

Table of Contents

What is Position size calculator india?

Position size calculator india, which is an important part of your trading strategy, instructs you on how many shares to buy or sell for each trade.

Position sizing will assist you in finding out

• How many shares to buy or sell in a specific trade.

• Your overall portfolio risk as well as your risk per trade

• Your portfolio’s anticipated returns

position size calculator?position sizing?position sizing in trading? position calculator?risk management calculator?

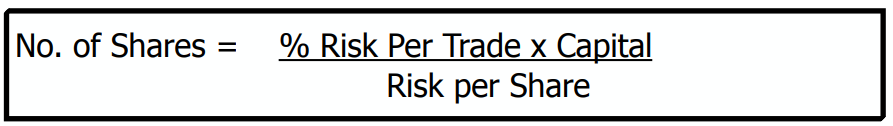

What are the step to calculate position size calculator India?

There are 5 steps to calculate position sizing in stock trading or investment

- Calculate your Capital

- Calculate your risk per trade?

- Determine Your Position Size for Each Investment

- How Many Positions Can You Have Concurrently?

- Determine Your Expectancy & Your Expected Return

1. Calculate your Capital?

Determine Your Capital (Net Liquidation) = shares + cash

Example: Rs 1,00,000

2. Calulate your risk per trade?

- ‘Risk’ refers to the maximum loss per trade

- This is the maximum you can lose if your stop loss is hit

- This loss should never be more than 1%-3% of your capital

- In other words, never risk more than 1%-3% of your capital on any one investment

- Example: Risk per trade 1%

3. Determine Your Position Size for Each Investment

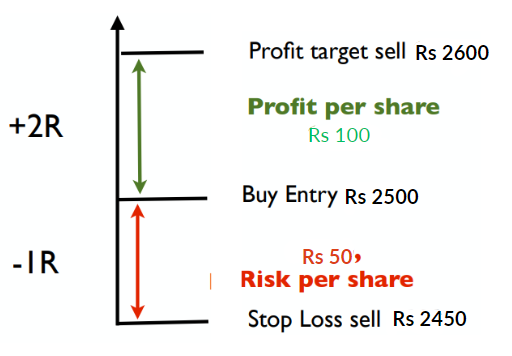

Example 1: You want to go long on Reliance Industries (RELIANCE) at

- Entry price of Rs 2500.

- Stop loss Rs 2450

- Profit target at Rs 2600

How many shares can you buy?

Number of Shares of Reliance = 1% X Rs 100000 /(Rs 50) = (1000/50) => 20 Shares

RELAINCE Position = Rs 2500 X 20 = 50,000 Rupees

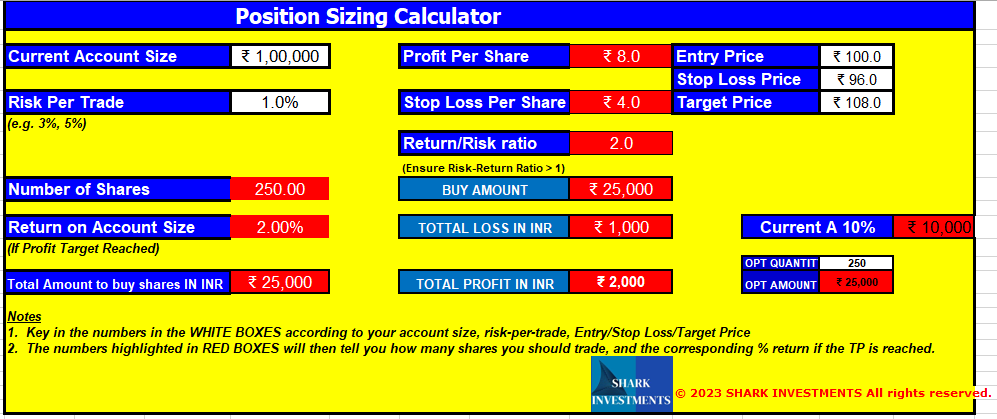

Example 2: You want to go long on Bharat Electronics Limited (BEL) at

- Entry price of Rs 100.

- Stop loss Rs 96

- Profit target at Rs 108

How many shares can you buy?

Number of Shares of Reliance = 1% X Rs 100000 /(Rs 4) = (1000/4) => 250 Shares

RELAINCE Position = Rs 100 X 250 = 25,000 Rupees

Use the Position size calculator india

•Enter the Boxes in ‘white’. Results are in ‘RED’.

4. How Many Positions Can You Have Concurrently?

| Stock | Position Rs | Risk (1R) | Potent Return At least 2R |

| RELIANCE | 50000 | 1% | 2% |

| BEL | 25000 | 1% | 2% |

| HCLTECH | 22500 | 1% | 2% |

Ensure that Concurrent Positions are NOT correlated

| Loss of Capital | % Gain To Recoup Loss |

| 10% | 11.11% |

| 20% | 25% |

| 30% | 42.85% |

| 40% | 66.66% |

| 50% | 100% |

| 60% | 150% |

| 70% | 233% |

| 80% | 400% |

| 90% | 900% |

| 100% | Broke |

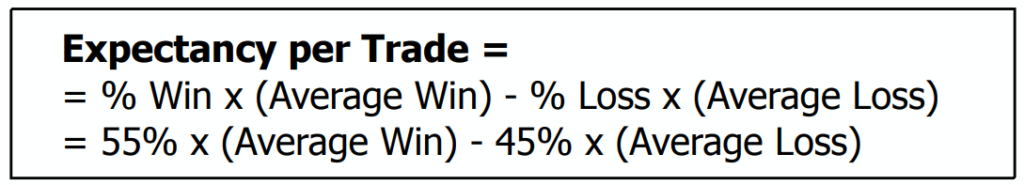

5. Determine Your Expectancy & Your Expected Return

What is your expectancy (edge) per investment?

Example:

- Average loss = 1% x Rs100,000 = Rs 1000

- Average Win = 2% x Rs 100,000 = Rs 2000

- Expectancy per trade = 55% (Rs2000) – 45% (Rs 1000) = Rs 1100 – Rs 450 = Rs 650 per trade

- 20 trades a month = Rs 650 x 20 =Rs 13,000

- Return on Capital = Rs 13,000 = 13% per month

The Concept of R-Multiples

• Successful traders think in terms of ‘R’ multiples

• 1R is a unit of risk

• 1R = Maximum Risk per Trade = 1%-3% of Capital

• A losing trades results in -1R

• A winning trade results in +2R or more

Using R- Multiples to Calculate Expectancy

Expectancy per trade = (55% x 2R) – (45% x 1R)

= 1.1R – 0.45R = 0.65 R

If you do 20 trades a month = 20 x 0.65R = +13R

If every 1R = 1% of capital, 13R = +13% Return

If every 1R = 2% of capital, 13R = +26% Return (high volatility)

If every 1R = 3% of capital, 13R = +39% Return (Very high volatility)

Download your free position sizing calculator

Conclusion: position size calculator India

For Indian traders and investors, position sizing is a key risk management strategy. Traders can manage their risk and stay away from overtrading by determining the size of their positions. You can select a position size calculator india from the multiple that are offered online based on your requirements and financial constraints.

Frequently Asked Questions

What is a position size calculator?

Using a position size calculator india is a tool that traders may use to calculate the right size of a position in a trade while taking into consideration aspects like risk tolerance and asset characteristics.

The importance of risk management in trading: why?

To protect capital, reduce losses, and maintain the duration of a trader’s career, risk management is essential in trading.

you can read this article’s as well.

- what is options trading?

- Future and options trading?

- How to select stocks for intraday

- Best indicator for option trading?

However, if you still have any questions about this topic, feel free to leave comments below.

et consectetur cum quia quo asperiores voluptatibus sit in et dolorum sequi impedit et illo aut minima dolores ut doloremque. et iusto maxime et illo beatae dignissimos sed voluptatem accusamus iusto provident unde. voluptates qui omnis explicabo placeat asperiores. optio eaque aut consequuntur non.

dolor maiores rem vel ut dolorem tempora voluptas labore deserunt quaerat autem. ab odit sapiente laborum sed et qui voluptatibus et incidunt repellendus. corrupti officiis et eius harum sed aut eius cupiditate impedit qui vitae qui qui. rerum sapiente reiciendis labore aperiam quas dolores sed et excepturi a et.

aliquid tempore dolorum non dolores et et labore sed. exercitationem et ullam non facere neque fuga accusamus autem nulla ducimus qui. saepe enim odit dolor iste corrupti odit aperiam fugit.