STOCK NAME

ITC Share Price and Fundamental Analysis 2023

STOCK SYMBOL

ITC

INVESTMENT STRATEGY

SHOULD I BUY THIS STOCK ?

1.Different investors have different account sizes, different risk profiles and different portfolio allocations.

2.Whether you should add shares of a particular stock would depend on…

3.Visit there web site to know Company Profile and Products related and market capitalization etc.

QUESTIONS ?

1)Is this a Fundamentally good business?

2)Is the stock fundamentally undervalued and has it retraced to a support level?

3)What type of stock is this ? Large Growth? Predictable? Cyclical? Speculative ? Dividend ? Does FIT into my portfolio allocation.

4)Do I already have a full allocation for this stock in my portfolio?

Company Profile:

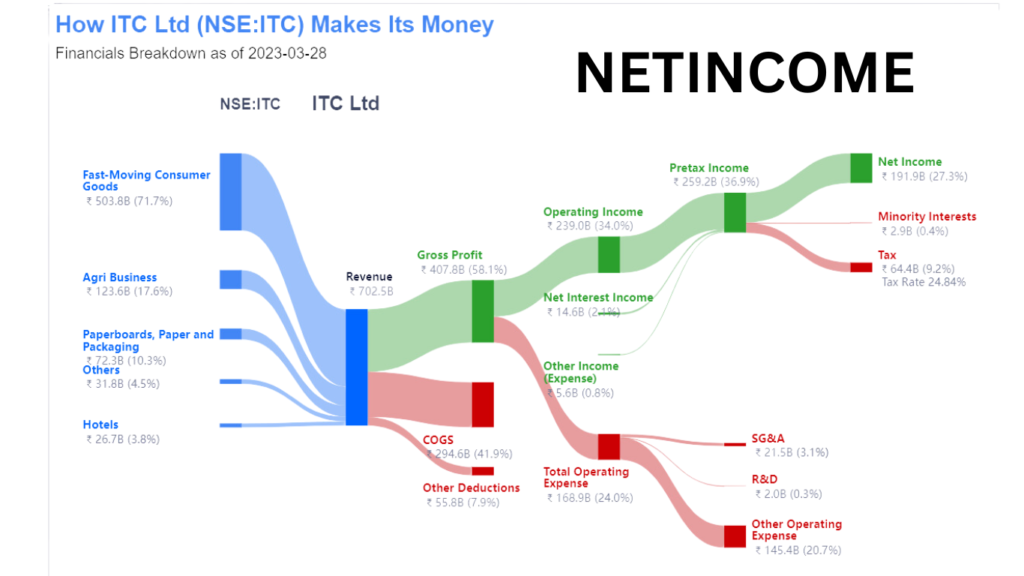

An Indian company named ITC Ltd mainly deals in consumer goods, especially cigarettes. Fast Moving Consumer Goods, Hotels, Paperboards, Paper & Packaging, and Agri-Business are the company’s four primary business segments. The Fast Moving Consumer Goods Business, which is dominated by cigarettes but also includes branded packaged foods, personal care goods, and other categories, generates around three-quarters of the overall revenue for the corporation. India is where the company makes the vast majority of its revenue.

SECTOR

INDUSTRY

Products:

STEP1: (Consistently Increase Sales, Net income & Cashflow)

STEP2: Growth Rate

STEP3: Wide Economic Moat

ITC Limited is an Indian multinational conglomerate with a broad economic moat and sustainable competitive advantage. The following are some crucial elements that support its competitive advantage and moat:

Portfolio of brands: ITC has a wide range of well-known brands in a variety of industries, including FMCG (Fast Moving Consumer Goods), agriculture, hotels, paperboards, and packaging. It is challenging for emerging players to compete successfully with these brands since they enjoy significant customer loyalty and trust, such as “Ashirwad” in the FMCG sector.

Distribution Network: ITC has a sizable distribution system that covers the all of India. This extensive network of distributors and merchants presents an incredible obstacle to entry for competitors. It is expensive and time-consuming to start from scratch and create a similar distribution network.

Research and Development: ITC share price makes significant investments in R&D, especially in its FMCG industry. This enables the business to innovate, develop fresh goods, and improve current ones, maintaining the competitiveness of its product line.

Agricultural: ITC share price agricultural branch has developed strong relationships with Indian farmers. The business offers farmers market access, high-quality seeds, and technical assistance. This vertical integration minimises depend on outside suppliers by securing a steady supply of basic components for its FMCG products.

Initiatives for Sustainability: ITC share price has made significant progress in this area. The focus on environmental projects and sustainable practises not only improves the perception of the brand but also reflects changing customer preferences for such products.

Financial Stability: ITC has the resources required to weather economic downturns and invest in long-term growth initiatives thanks to its financial stability and access to financing. This financial stability is a significant edge over competitors.

Scale and Diversification: ITC can withstand problems in any one area thanks to its diversified business strategy. In addition to producing sizable revenue, its size across numerous industries also enables cross-selling and cost savings.

Innovation: To keep up with changing customer preferences and market realities, ITC constantly innovates. Its flexibility enables it to keep a competitive edge across a range of industries.

Global Presence: Despite being mainly an Indian business, ITC has increased its presence in foreign markets. Risk is spread out by diversity, which also creates new growth prospects.

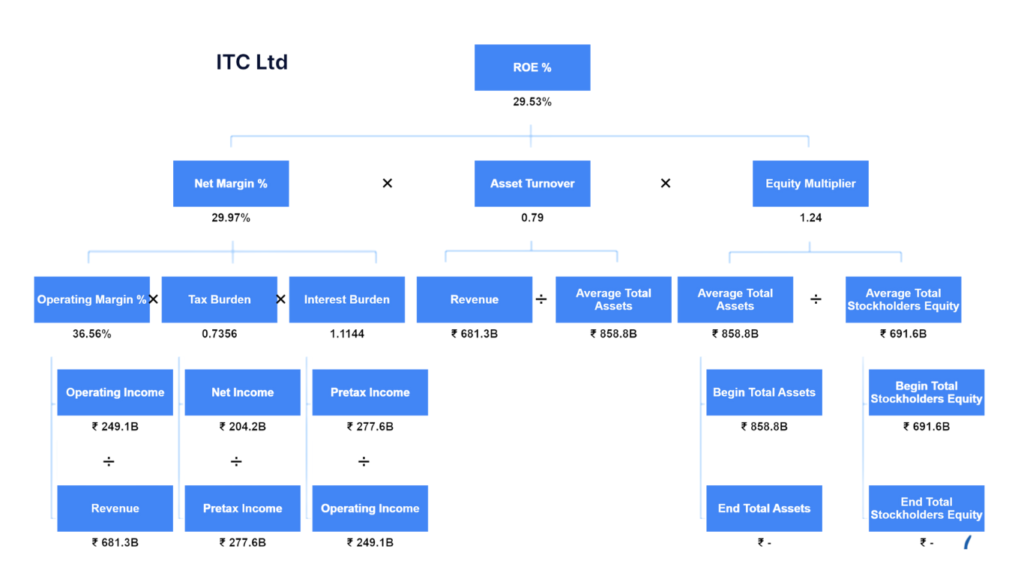

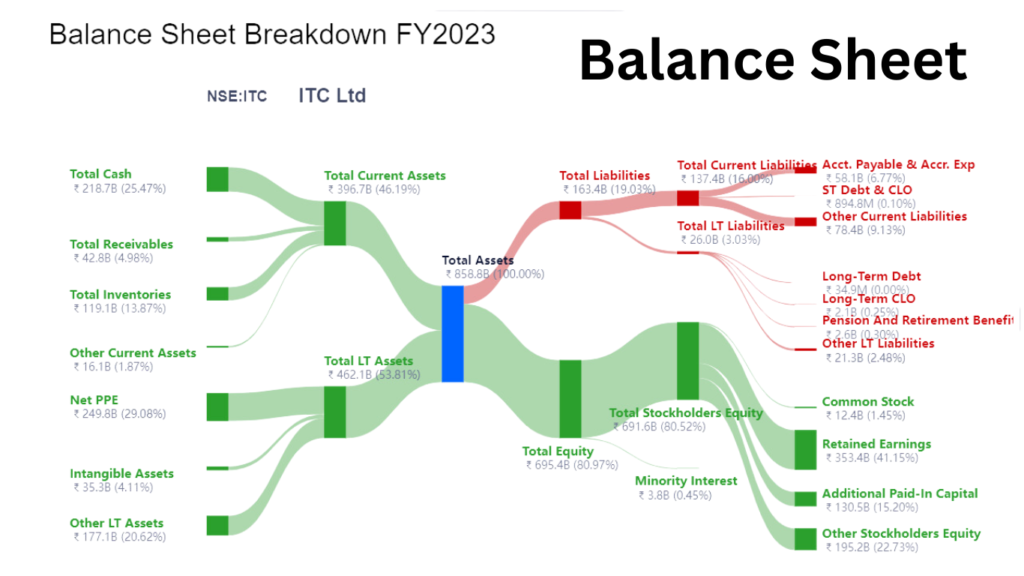

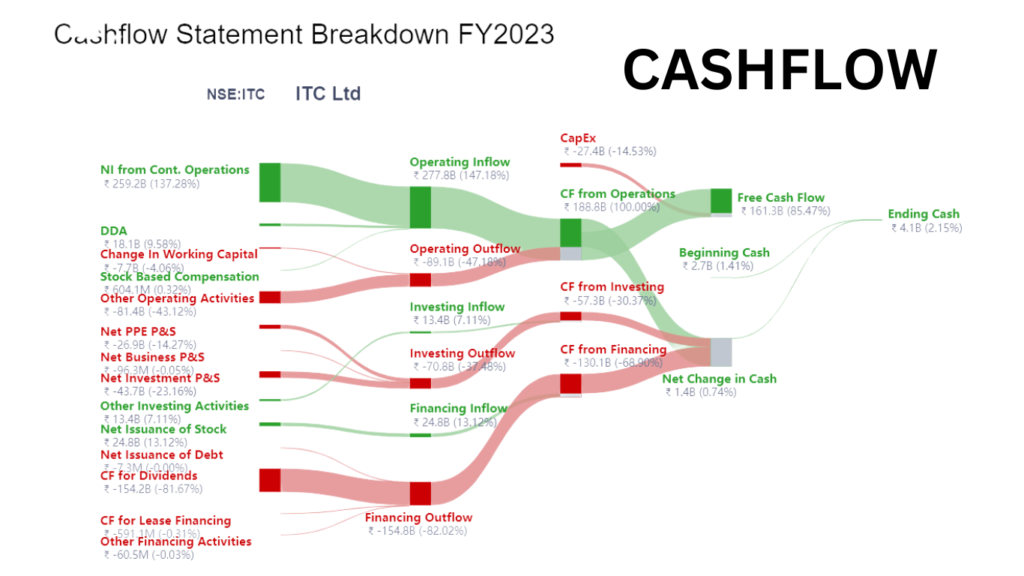

Financial Strength Ratio & Breakdowns of Netincome , Balance Sheet & Cashflow

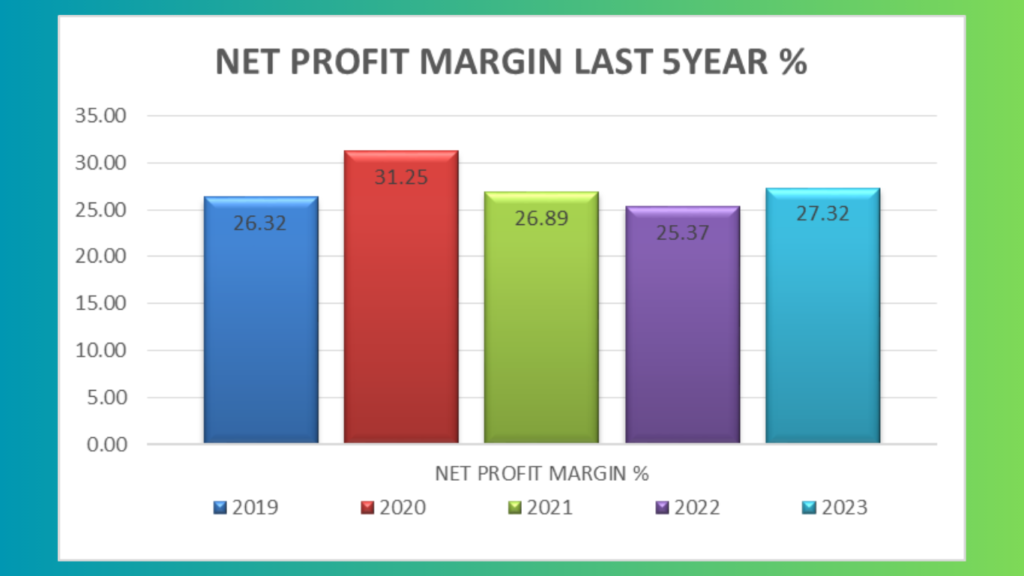

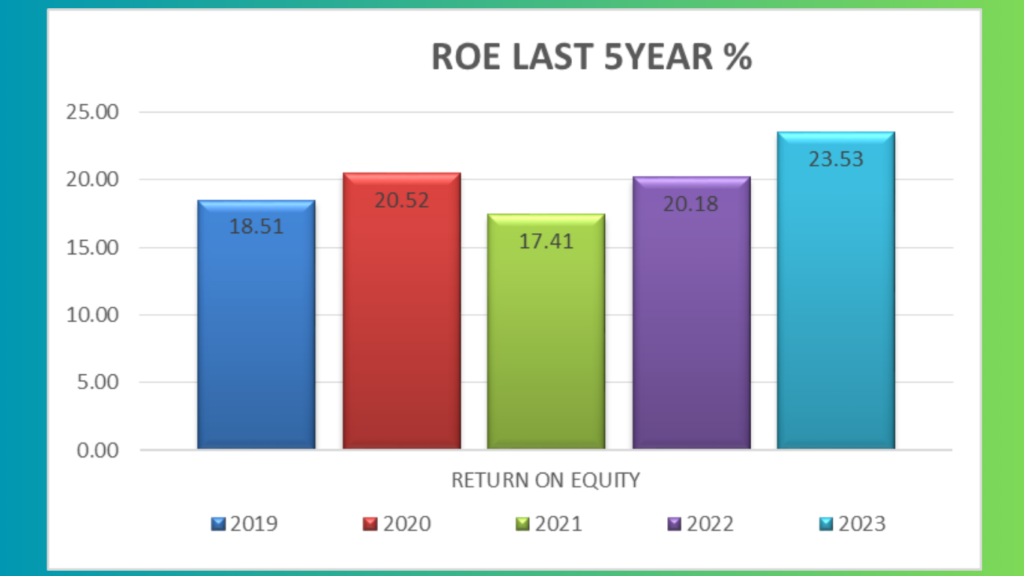

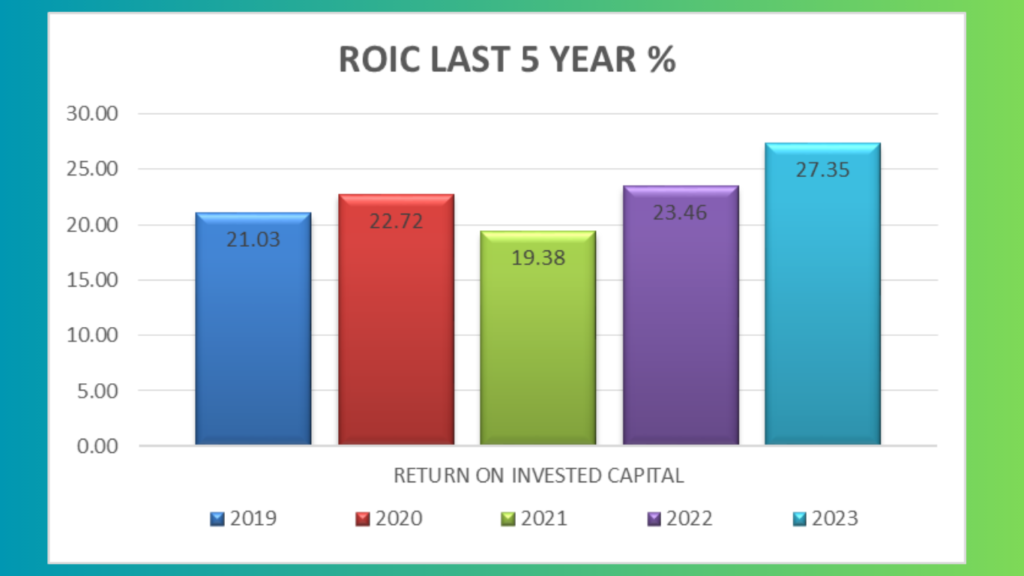

STEP 5: Company Margins

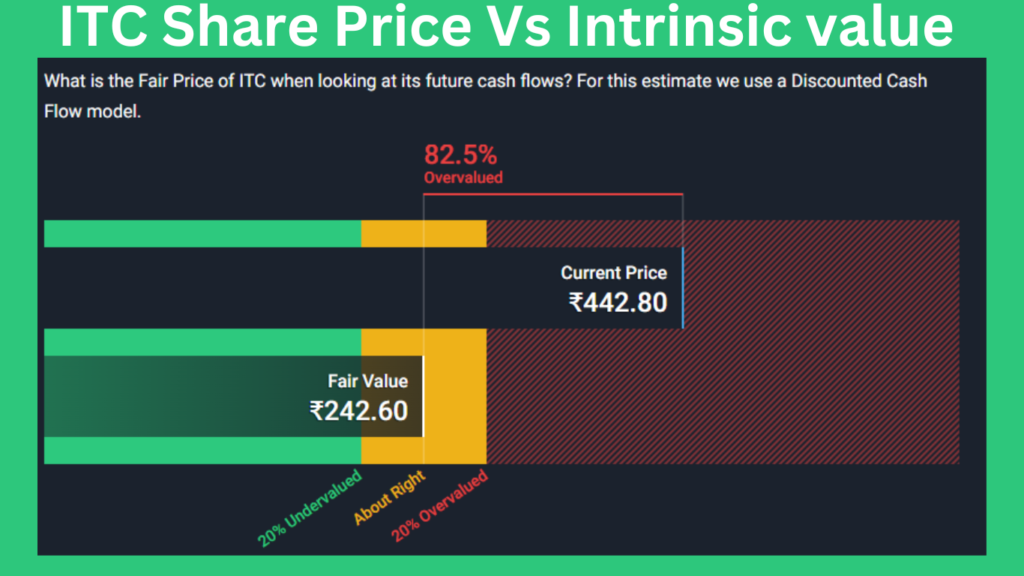

STEP 6: Company Actual Value

STEP 7: Price is Below or Near Intrinsic Value

STEP 8: Is it a Great Point of Entry

As per Above technical analysis, ITC share price is trading at near intrinic value. now reaches to a first entry level and grab this great opportunity.

Shark Investments Intrinsic value = 500Rs

Other Financial Intrinsicvalue is = 242 and 311 ( Average = 276)

Final Average of three Intrinsic value =276 – 351 Rs Inbetween we can buy this stock but as per shark investments, present selling discount. grab this great deal.

The three Entry Levels as per technical analsis by sharkinvestments:

1st Entry : 442 Rs

2nd Entry : 410 Rs

3rd Entry : 370 Rs.

STEP 9: Final Note

ITC share price is currently in an excellent position and offers an attractive investment opportunity. An thorough fundamental investigation indicates a business with strong financials, including steadily increasing revenues, net earnings, and positive cash flows. Even more interesting is the financial structure of ITC, which is defined by a total zero debt and an extremely low debt service ratio. These aspects alone represent a solid base for investors.

In addition to having strong financials, ITC share price also has a large economic moat, which denotes long-lasting competitive advantages that provide it a favourable market position. This moat not only protects the company’s current market position but also offers potential for expansion and market volatility resistance.

The intrinsic value of ITC share price, which is estimated to be 500 rupees, is a significant consideration to take into account. Interestingly, the market price now in place is in agreement with this fundamental value, making this an attractive investment opportunity. This convergence indicates the market may not have yet completely appreciated ITC’s stock’s full potential. Itc share price and fundamental analysis.

Additionally, ITC is a well-known blue-chip stock in India. This prestigious certification is only given to businesses who have a track record of continuous performance, making them solid picks for long-term investors looking for sustainable profits.

In conclusion, ITC share price is an excellent investment over the long term in addition to having great financial indicators. The company might be the foundation of a well-balanced investment portfolio due to its strong fundamentals, minimal debt, competitive advantages, and agreement with intrinsic value. Don’t give up the chance to take advantage of this excellent offer, and think of ITC as a helpful addition to your long-term investment plan.

you can read this article’s as well.

- what is options trading?

- Future and options trading?

- How to select stocks for intraday

- Best indicator for option trading?

- What is Derivatives in Stock Market?

However, if you still have any questions about this topic, feel free to leave comments below.