opstra option strategy builder,Opstra Definedge is a versatile trading system that can be used by both options and futures traders. A wide range of tools and features are available, including the Strategy Builder, IV (Implied Volatility) chart, Options Backtesting, Options Simulator, and many more. Particularly, one of the most frequently used tools on the platform is the opstra option strategy builder.

Table of Contents

Opstra Option Strategy Builder Overview

The Opstra Option Strategy Builder is a web-based tool allowing traders to develop and use options trading strategies. To help traders take smart decisions, it provides a user-friendly interface and a wide range of features. Opstra can help you whether you want to make money, hedging your portfolio, or making market predictions.

What is opstra option strategy builder?

A platform called Opstra Definedge offers many of the features required for options trading online. OI (Open Interest), options backtesting, option simulators, event calendars, etc. are a few of these.

What is the Opstra Strategy Builder’s use?

Opstra is a flexible platform with lots of features. New as well as experienced traders may find beneficial tools in Opstra depending on their need. How to use opstra option strategy builder is as follows:

How to Begin with Opstra?

You must create an free account on Opstra’s website in order to begin connecting with them. Once you have access, you can look through the many features and tools at there for you.

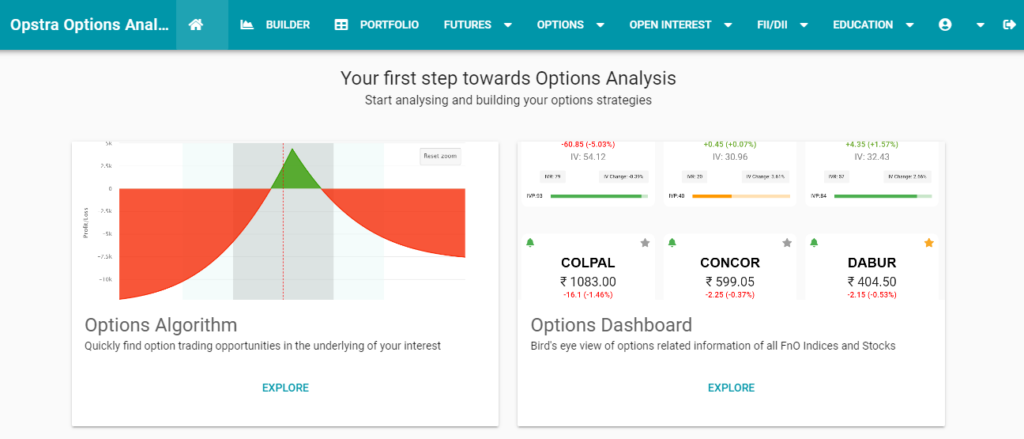

How to Use the Dashboard?

You will be welcomed by the simple Opstra dashboard as soon as you log in. You get access to all the necessary features, such as portfolio monitoring, backtesting, and strategy formulation, here.

Steps to create a opstra option strategy builder.

Developing options trading strategies is the main use of Opstra. You can take the following actions to create a strategy in Opstra option strategy builder:

- Open Opstra Definedge first, then select the Portfolio tab in the top left-hand area of the interface. Next, choose “Strategy Builder.” You can create your own strategies based on any underlying asset in the strategy builder section after choosing here. The Strategy Builder’s homepage looks as it does in the image below.

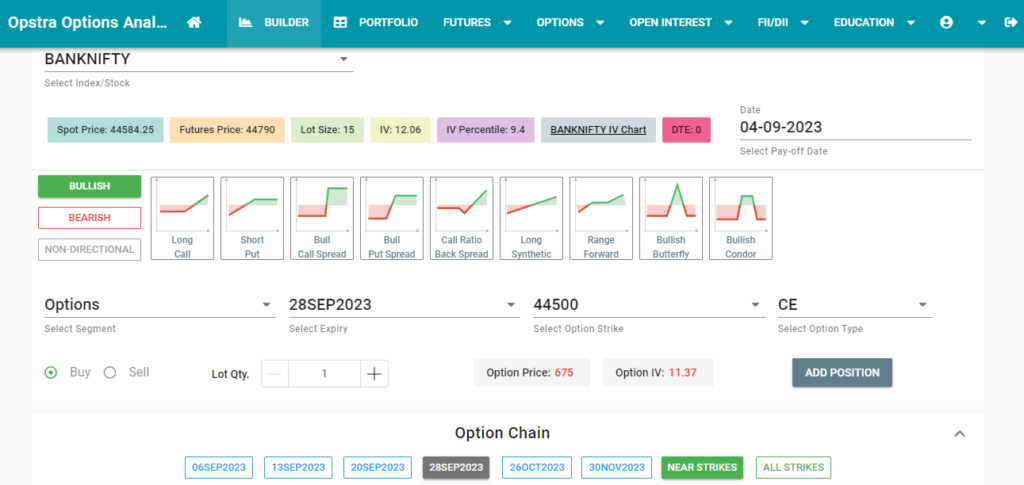

- You have to choose the underlying index or stocks for which you want to create a strategy in the top region. Let’s use “BANK Nifty” as an example. You will find important price points for the selected asset, such as the Spot price, Futures price, IV (Implied Volatility), and IV Percentile.

- You must determine whether to use options or futures once you’ve made the decision to create a strategy. You should select “Options” from the “Select Segment” menu if you decide to use an option strategy. Choose a time frame for setting your strategy into effect after making your choice. You can choose between weekly and monthly expirations to match your plan because they are both offered.

- After deciding on the expiration date, enter the strike price that works best for your plan. OTM (Out of the Money), ATM (At The Money), and ITM (In the Money) are the three different types of strike prices. Choose the one that best suits your strategy.

- The next step is to choose whether you want to execute a call option or a put option, depending on the type of option. In the “Option Type” box, choose the desired option type.

- You must choose whether your strategy involves option buying, option selling, or a combination of both (buying and selling) once you have decided on your strike price and option type (Call or Put). Choose “Buy” or “Sell” in accordance with the strategy type after making your selection. Afterward, specify the necessary quantity and press “Add Position” to finish the procedure.

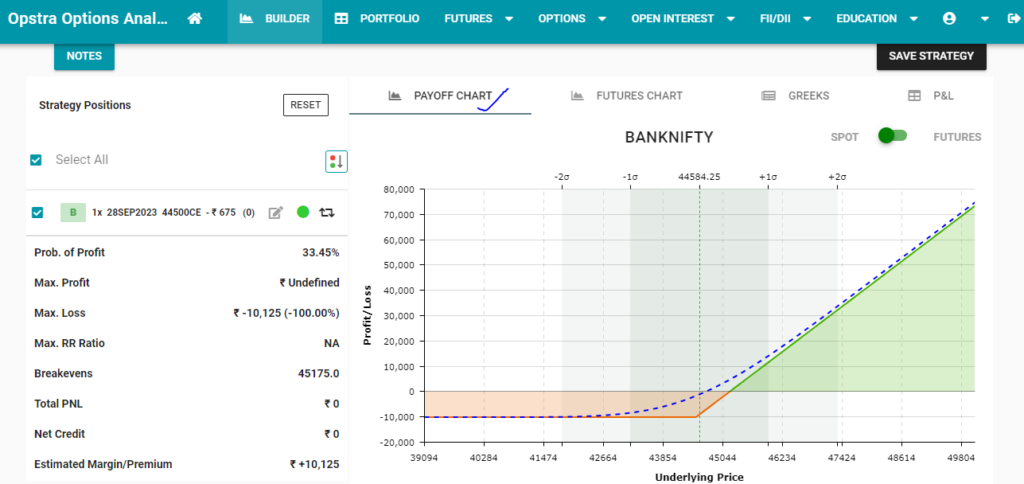

- For instance, you would need to purchase two OTM options (Call and Put) with the same expiration date and underlying asset if you wanted to put up a long strangle. You must add one option to the strategy’s two Option contracts before repeating the steps for the other Option contract. You’ll be able to keep an eye on things like profit and loss, the payoff graph, option Greeks, and more once you’ve finished these stages.

Back-Testing Your strategy

Backtesting the strategy using previous data is important before investing actual money. To evaluate your strategy’s success in various market scenarios, Opstra offers powerful backtesting tools.

Risk and Reward Analysis

One of the core concepts of trading options is risk management. Opstra helps you in determining the potential risk and benefit of your strategy, helping you to make intelligent choices.

Conclusion:opstra option strategy builder

In conclusion, Opstra is a useful tool for traders and investors since it provides a user-friendly platform for creating customised options trading strategies based on your preferred underlying assets, expiries, strike prices, and option types.

FAQ’s : opstra option strategy builder

How can Opstra help me in trading options?

You can get help from Opstra by taking advantage of a variety of skills, such as strategy changes, backtesting, risk analysis, and real-time monitoring. It enables traders to implement strategies successfully and make informed selections.

Is prior knowledge required in order to use Opstra Option Strategy Builder?

Opstra helps both beginner and experienced traders. While offering powerful features for experienced traders, it offers a user-friendly interface and educational resources to help beginners get started.

you can read this article as well.

I really hope that you found the content to be beneficial. If you have any questions about this article, please leave a comment below.