Bank nifty intraday option trading has grown significantly in favour among investors in the exciting sector of finance. A single trading day’s worth of price variations in bank nifty options can be profited from using this flexible and satisfying trading method. For newcomers, it might be difficult to understand the complexities of bank nifty intraday option trading. This thorough guide wants to explain the procedure and provide you with all the knowledge and skills need to be successful in this interesting attempt.

Table of Contents

Understanding the Bank Nifty

What is Bank Nifty?

The performance of the Indian banking industry is reflected in the benchmark index known as Bank Nifty. It consists of the National Stock Exchange (NSE)-listed banking equities that are most liquid and widely traded. Traders and investors frequently use Bank Nifty to determine the performance of the banking sector generally and to guide their trading decisions.

How to do Bank Nifty Intraday option trading?

Trading intraday options on the Bank Nifty index is a common practise on the Indian stock market. It involves buying and selling options contracts on the Bank Nifty index, a collection of the top 12 Indian banking companies. Bank Nifty intraday option trading can be extremely beneficial, but it’s also important to understand the risks involved.

How to do Bank Nifty Intraday option trading?Bank nifty option trading strategy?Best intraday strategy for bank nifty?Bank nifty 2pm strategy?

Why Trade Options on the Bank Nifty?

Bank Nifty intraday option trading give traders a unique opportunity to profit from fluctuations in the index’s price without actually holding the underlying equities. For individuals trying to hedge their portfolios or profit from sudden price swings, this can be especially helpful.

What is Option?

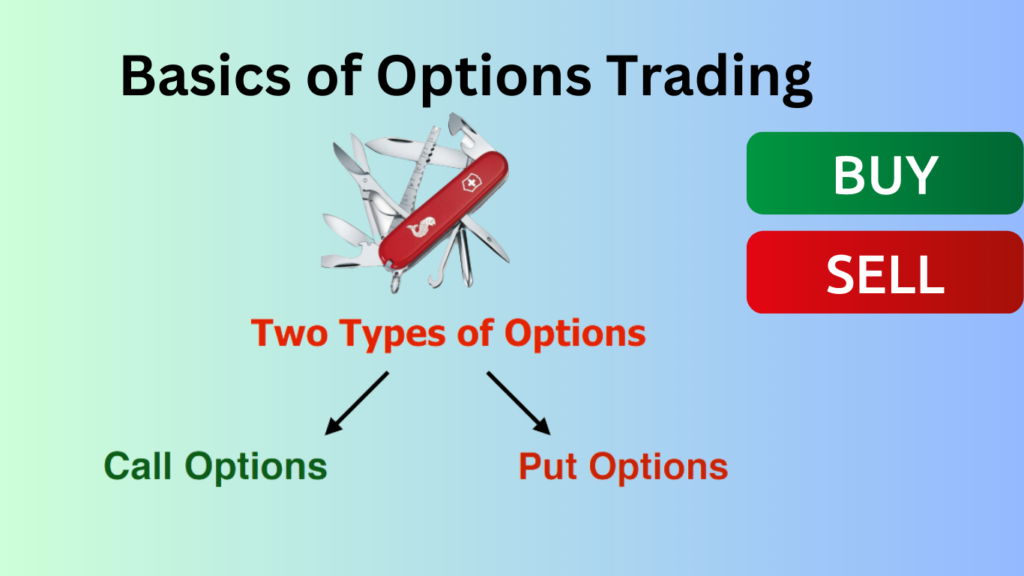

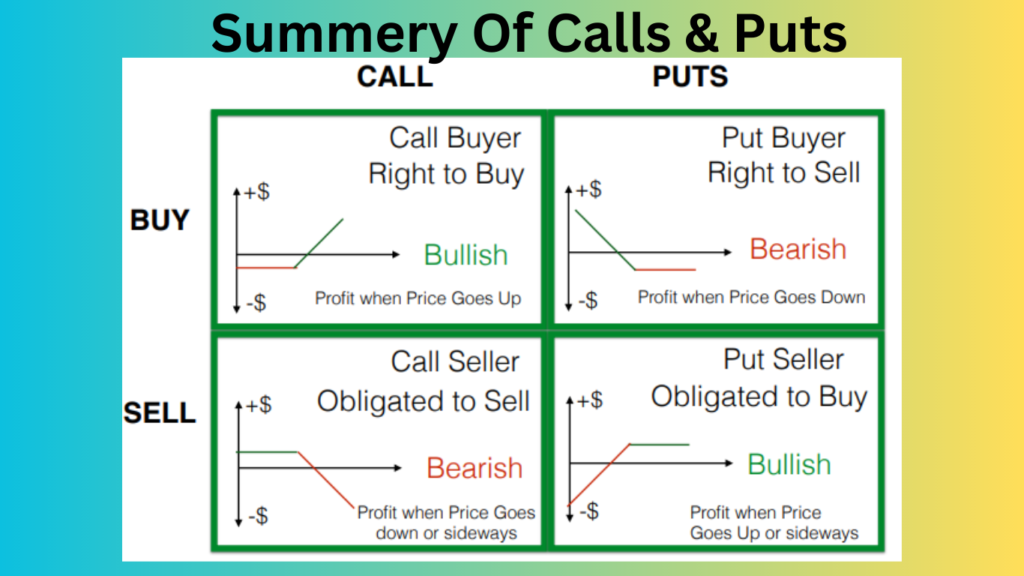

An option is a type of derivative contract that gives the person who holds it the right to profit whether the value of the underlying asset rises or falls. Options are used in option trading on the stock market. The objective of this trading strategy is for traders to profit by trading two separate options kinds, “call option and put option”.

The advantage of using options is that you can buy or sell the underlying asset for a relatively low premium (or little fee). You gain financial gain when your prediction comes true and the share price in the market adjusts accordingly.

- The underlying asset may be any stock or index (such as the Nifty or BankNifty). There is a weekly or monthly expiration date for each option.

- While the index expires every Thursday, the stock has a monthly expiration date that happens on the final Thursday of the month.

- As a result, you must sell an option you bought before it expires.

- For people who want higher returns with less money, options are the best way to make money.

How many types of options are available?

There are two types of options are available i.e. CALL option and PUT option. When market goes up CALL option price will increase and when market going down the PUT option price will increase

When trading options, you must use one of the following various strike prices:

- In the Money Option (ITM)

- At the Money Option (ATM)

- Out of the Money Option (OTM)

Placing an order

In order to make an order for an options contract, you need to provide the following information:

- The order’s type (market, limit, or stop-loss order)

- The number of options contracts you wish to buy or sell of

- The options contract’s strike price

- The date on which the options contract expires

- Your stockbroker will execute your order at the best price after you’ve placed it.

Bank Nifty Intraday Option Trading strategies

You can use a number of Bank Nifty intraday option trading tactics. However, a few of the most well-liked tactics are as follows:

Day trading: On the same day, day traders buy and sell options contracts. They frequently use technical analysis to spot quick price changes.

Swing trading: Swing traders keep options contracts for a couple of days or a couple of weeks. They frequently use technical analysis to spot temporary to medium-term price changes.

Trading in positions: Traders in positions keep option contracts for a number of weeks or months. To pinpoint long-term price trends, they frequently turn to basic analysis.

Research of Market Trends:Keep up with the most recent market trends and news that may affect how Bank Nifty performs. To find probable entry and exit positions, use technical analysis tools and indications.

Management of Risk:Implementing risk management measures is essential since intraday trading can be unpredictable. Never invest more than you can afford to lose; instead, set stop-loss orders to limit prospective losses.

Execution of Trades:Trades should be executed precisely. To enter and exit positions at the desired price levels, use market orders or limit orders. Every day long, keep a close watch on what you’re buying.

Shark Investments RSI 15min and 1hr Strtegy:

as per above image RSI Monthly and weakly above 60 RSI then Bank nifty is strong bullish on long term. We have to select now when ever bank nify is at 40 RSI support on 15Min and 1hr or Daily chart then we have to buy CALL option. If RSI below 40 on Monthly and Weakly then we can say Bank nifty Bearish momentum for long term. Now we have to select Bank nifty intraday option trading, when RSI taking 60 Resistance on 15min or 1hr or 1day chart then we have to short the market means we should buy PUT option.

you can read this article as well.

- what is options trading?

- Future and options trading?

- What is volume in stock market?

- How to earn 1 lakh per day from share market?

- Best stocks to trade in stock market?

- How to select stocks for intraday

- Best indicator for option trading?

Conclusion:

Bank Nifty intraday option trading can be profitable for traders who are prepared to put in the time to study and practise. You may confidently go through a variety of intraday options if you have an in-depth understanding of the fundamentals, come up with a solid plan of strike, and practise discipline.

FAQ’s of Bank Nifty Intraday option trading

Is Bank Nifty intraday option trading appropriate for beginners?

Despite the difficulty, newcomers can begin with little deposits and progressively build up experience.

How can I pick the right strike price for my option trades?

Your market analysis and risk tolerance will influence the strike price you choose. Get guidance from your broker or financial professional.

What hours of the day are optimum for trading Bank Nifty options?

The morning and closing hours of the trading session are often when Bank Nifty intraday option trading are traded the most actively.

Can I trade intraday options with leverage?

Leverage is possible, but there is a higher risk involved. Use leverage wisely and with caution.

As a result, please spread this information on social media and leave a comment below if you have any questions.

One Comment on “How to do Bank Nifty Intraday option trading?”