Nifty Prediction for tomorrow, the ability to accurately predict Nifty performance for the upcoming trading day is highly prized in the fast-paced world of stock trading. In this post, we clearly explained 10 practical techniques that traders and investors may use to get knowledge and determine the nifty prediction for tomorrow.

How to predict Nifty, when will Nifty rise or fall, how will Nifty be tomorrow, what happened Nifty 50 tomorrow, how much will Nifty go up or down tomorrow?different way to find nifty prediction for tomorrow?

Table of Contents

nifty prediction for tomorrow? nifty prediction for tomorrow? tomorrow nifty 50 prediction?nifty? prediction for tomorrow by experts? expert view on nifty tomorrow? nifty support and resistance tomorrow

Nifty 50 target for tomorrow

So today’s topic is Nifty prediction for tomorrow, or when will the Nifty rise and fall. How can I predict the Nifty 50 for tomorrow? How many points will the Nifty increase or decrease?

Yes, it is true that predicting the precise figure by which the Sensex and Nifty will rise or fall is extremely difficult.

However, there are some techniques that very experienced people can use to create nearly correct predictions of Nifty.

Today, we’ll go into more detail regarding a few of these techniques.

How to know when Nifty will go up or down? (How to predict Nifty movement)

“In order to predict whether the Nifty will increase or decrease, you must thoroughly evaluate the market direction. It is also possible to anticipate how much the Nifty will increase or decrease tomorrow by using several technical indicators, such as support and resistance, moving averages, chart patterns, option chain data, put call ratio, etc.”

as you are aware;

The performance of the top 50 Indian companies determines how the Nifty50 index will move the next day.

However, a number of other global factors, such as any negative news that affects investor confidence globally and has an effect on the Indian stock market the next day, also contribute to the ups and downs of the Nifty chart.

However, some people consistently make thousands of rupees in profit by making predictions about the Nifty; how do these people do it, and how can you do it?

Of course, anyone may do this, but you should have a basic understanding of trading and technical analysis. Additionally, one should have a basic understanding of derivatives like future options, put-call ratios, charts, and many other indicators.

- Observe, nobody can predict whether the price of the Nifty will rise or fall tomorrow.

- Using just a few indicators, certain Nifty experts estimate an increase or decrease of Nifty, which provides a very accurate picture of Nifty’s performance.

We’ll talk over a few of these factors today so you may determine for yourself how the Nifty will be tomorrow and how much it will increase or decrease by understanding it.

Find 10 ways to Nifty prediction for tomorrow.

Let’s now talk about each point individually:Nifty prediction for tomorrow

1. Check Nifty’s support and resistance levels.

Technical analysis support and resistance levels are essential to trading.

On the chart, Support and Resistance are shown as below for Nifty prediction for tomorrow

If you look at the Nifty chart, you will need to identify its support and resistance levels. You may do this by using multiple trendlines to determine what Nifty’s next target will be.

2. Look at Banknifty charts for nifty prediction for tomorrow

Because Bank Nifty makes up 30–40% of the Nifty index, it has a significant impact on whether the Nifty rises or falls. For this reason, it is crucial to look at the Bank Nifty chart when making predictions about the Nifty.

One thing is sure: if Bank Nifty falls, Nifty will follow accordingly, and if Bank Nifty rises tomorrow, there are many chances that Nifty will follow pattern. For this reason, you should always look at the Bank Nifty chart while analysing the market.

3. Watch SGX Nifty Chart Daily

The majority of Indian traders use Singapore Nifty, or SGX, to estimate the Nifty. You may view the SGX Nifty chart even before the Indian stock market starts, which provides you with advance notice that you should forecast the similar movement when the Indian stock market begins at 9:15.

You must read this post because Singapore Nifty has a significant impact on the Indian stock market.

using morning morning data of SGX nifty we can find the way of nifty prediction for tomorrow.

4. View the NASDAQ chart

The IT index of the American stock market is called NASDAQ. It can be seen from Nifty IT’s performance in India that the big Indian IT companies such as Mphasis, Hcltech,TCS, Infosys, Wipro, etc., are doing well.

Similar to this, it is possible to determine the success of the technological companies represented on the Nasdaq in America by looking at its chart.

In this case, how can we determine how the Nifty in India would behave the following day by looking at the NASDAQ chart?

So as you can see, you would be aware that the US market, which has the biggest impact on the European market and subsequently the Asian market, drives movement in the majority of global markets.

Nasdaq and Dow Jones are the two primary indexes used in the US stock market; we focus more on Nasdaq because it has 100 shares and because IT and financial stocks are given the index’s highest weighting.

Now, some people might question why we didn’t use the S&P 500 as that is also the USA’s index. As you can see, it has 500 shares, which are very over-diversified and do not provide a clear view of the market, therefore we decided against taking it.

While the NASDAQ index, which is an index between the Dow Jones (which comprises 30 stocks) and the S&P 500, makes a great deal more accurate predictions of the American market.

You have to look at the daily, weekly, and monthly Nasdaq charts in order to predict how the Nifty will trade tomorrow.

If you look at its daily chart and the closing price is low, there is an opportunity that the market will go down the following day, and if the closing price is high, there is a good possibility that the market or Nifty will decrease the following day.

Similar to this, on the weekly and monthly charts, if the Nasdaq index closes close to its weekly or monthly high at the end of a strong or month, there is a good chance that the market will rise the following week or month.

how we can find nifty prediction for tomorrow? what are the paramenters to find nifty prediction for tomorrow?

Additionally, there is a significant chance that the market might drop in the coming week or month if the closing price closes close to the low.

5. S&P Vix and India VIX should be monitored.

India VIX and S&P Vix are volatility indices that reflect investor sentiment. If there is a general sense of concern in the market and investors are panic-selling, then India VIX and S&P Vix will go up.

On the other hand, when the market rises, the India VIX and S&P VIX start to decline, indicating that investors are becoming more greedy.

You’ve seen that this index moves in the opposite direction of the market, so if the market increases, this index will decrease, and if the market decreases, this index will begin to increase.

- You can determine how investors feel about the Indian and American markets by looking at the India VIX and S&P VIX. If you are aware of the general mood there, there is an opportunity that the sentiment among Indian investors would be the same.

Because America is closely connected to both the direct and indirect global markets.

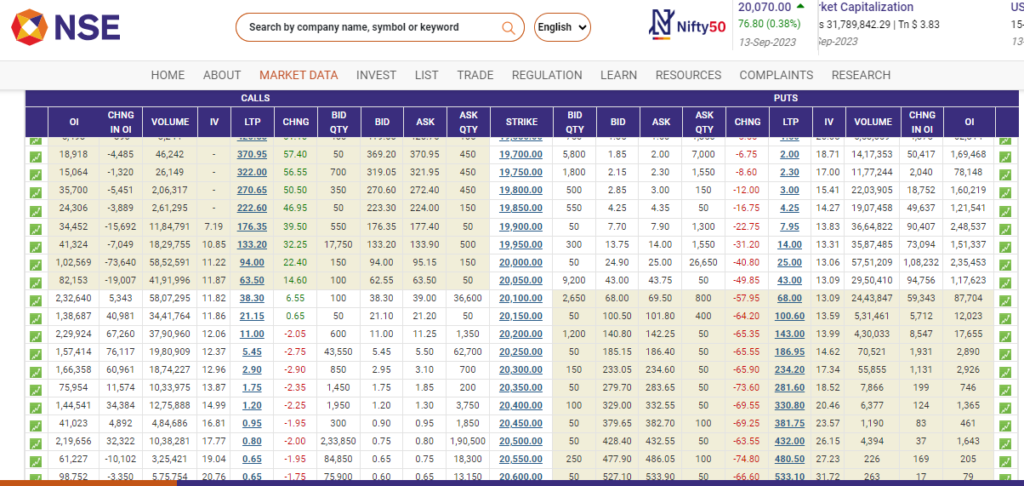

6. By Reading option chain data

Do you use the NSE website to look at data from the option chain? If not, you are in the process of making a clever prediction one step behind.

I can see why someone could feel nervous the first time they see the option chain data, but after you learn to read it, it will appear relatively easy.

The option chain data looks like this:

You can identify Nifty’s near support and resistance levels with the help of option chain data. Charts can also be used to determine support and resistance levels, but the support and resistance levels that result from the option chain data are more precise.

Option chain data is also used to create the following day’s trading strategy.

It is important to look into the option chain data when projecting Nifty since it additionally allows you to understand if you should book or keep the option until it expires if you make a profit from the trade.nifty prediction for tomorrow using this option chain can find.

7. Monitoring the put call ratio

Put Call Ratio is also known as PCR in short, and a number attempt to predict the direction of the market by looking at PCR data since it reveals the buying and selling feeling in the market.

Which buyer or seller is more powerful in the market, then? The market will increase if buyers are more dominant and decline if sellers are more prominent.

Both the put and call options are traded. If you buy a put, you are betting that the market will go down the following day, so if it does, you will profit; if it doesn’t, you will lose money.

Similar to this, buying a call option indicates that you are placing a bet on the market increasing and you get to benefit if this happens the next day.

- Most people simply use PCR data, which has an intraday accuracy of about 70%.

For this reason, put and call ratio data is important for understanding how the market will behave tomorrow. easily can find the way of nifty prediction for tomorrow.

8. Watching price action movement

The term “price action trading” refers to trading that is focused on price since, as the name implies, actions must be based on price. by studying price action also can find nifty prediction for tomorrow.

It is seen to be important to observe this in the market since occasionally, as a result of news, market sentiment might change when the price is indicating something else. In situations like this, it has generally been observed that the choice made based on pricing is the best one.

It is important for any investor who trades on the stock market to understand Price Action analysis since it allows you to predict the movement of Nifty to a great deal.

9. By Using Moving average indicators

An indicator that displays market movement is the moving average. It indicates how much the market can rise or fall throughout a specific period of time.

The chart’s moving average appears as follows:

Moving averages are used differently by different people. Some traders use a 20-day moving average while others use a 50-day moving average and so on. You can take any number of moving average, but it is not guaranteed.

You may get a sense of how much Nifty can rise or fall in a week or a month by looking at its moving average. very very important topic to find the nifty prediction for tomorrow.

10. Using RSI Indicators for nifty prediction for tomorrow

Although there are several technical analysis indicators, the RSI indicator is one of the most widely used, and many individuals base their buying or selling decisions on it.

These indicators show how far an asset is from being overbought or under bought. A stock enters the overbought zone if there has been an excessive amount of buying, and the under bought zone if there has been an excessive amount of selling.

- You can find out whether the Nifty is significantly in the overbought or under bought zone by opening the Nifty 50 and applying RSI indicators to it.

You can see from this that if the market is overbought today, there is a high probability that selling pressure will be produced in the market in the days to come and that the Nifty is going to fall in the future.

FAQ’s: Nifty prediction for tomorrow

How to know What will happen to the Nifty next day?

You have to analyse the trend and determine the direction it is moving in order to predict what will happen with Nifty prediction for tomorrow o. PCR data, option chain data, and other data sources can also be used to anticipate the direction of the Nifty the following day.

Can you predict the Nifty?

No one knows the direction of the stock market with 100% accuracy, but you may predict Nifty to a large extent using the techniques described in this essay.

How to know how Nifty 50 will be tomorrow?

The market’s sentiment will determine how the nifty50 will perform the next day; in other words, if the stock market is positive, the market will rise, and if any bad news is released, the market will fall.

Conclusion:nifty prediction for tomorrow

In this article, I’ve included 10 ways of predicting how the Nifty will perform tomorrow, the time that the Nifty 50 will increase or decrease today, as well as some nifty prediction for tomorrow tips that you may use.

Comment here and let me know how you predict the Nifty?

Please ask me a question in the comment section if you have any inquiries about this content.