call and put option edelweiss trading must be something you’ve heard about. These are known as CE and PE in short. But what exactly do call option and put option mean, how do they operate, and how can you quickly understand them? Detailed information on them will be provided to you today.

Continue reading this article until the end if you want to understand about your possibilities in very basic terms. Because I’ve tried to clarify everything to you in this article in as simple a way as I can, even if this is your first time entering the stock market, all of your concepts should be clear apparent.

Table of Contents

Introduction: call and put option edelweiss

It’s important to have a deep understanding of basic concepts in the fast-moving field of finance, where every choice has an opportunity to build or break professions. These two important concepts,call and put option edelweiss are the building blocks of option trading. The following article will clarify these words and explain their relevance in the world of investments, whether you’re a potential trader or just interested.

What is Option?

A derivative contract known as an option allows the right to profit when the value of an underlying asset increases or decreases. In the stock market, options are used in option trading. In this, traders’ goal is to make money by trading two different options types, “call and put option edelweiss”.

The benefit of using options is that you only need to pay little premium (or small fees) in order to buy or sell the underlying asset. When the share price in the market changes in line with your prediction, you subsequently make money.

- Any stock or index (such as the Nifty or BankNifty) can act as the underlying asset. Each option has a weekly or monthly expiration date.

- While the index expires every Thursday, the stock has a monthly expiration date that happens on the final Thursday of the month.

- Consequently, after buying an option, you must sell it before the expiration date.

- For people who want higher returns with less money, options are the best way to make money.

How many types of options are available?

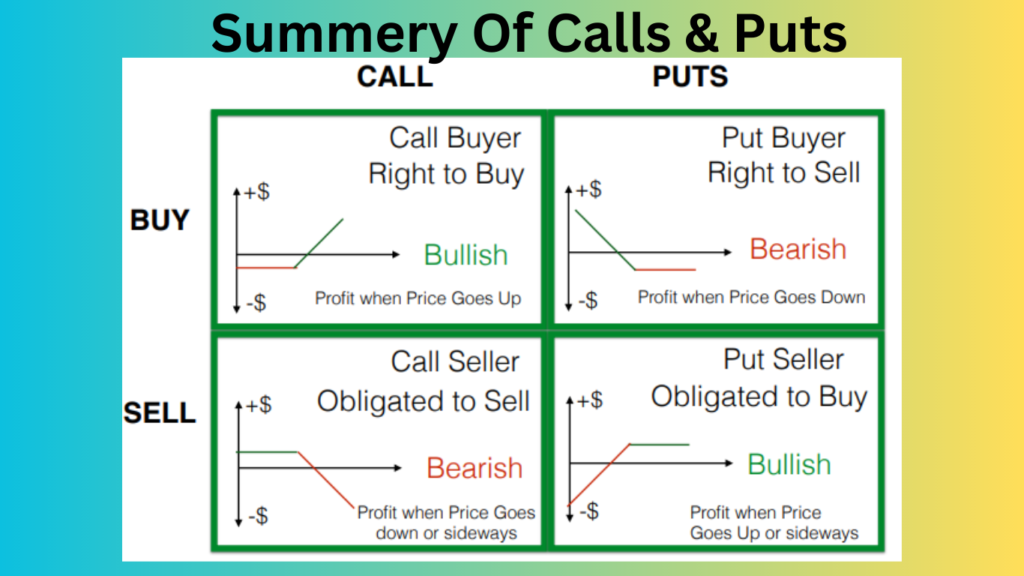

There are two various types of options: call and put option edelweiss. The terms CE and PE for options are call and put, respectively. Call European and Put European are the full forms of the words, respectively, for CE and PE.

- When the stock market is bullish, call options are bought; conversely, put options are bought when it is bearish.

- This simply means that you should buy Call options when you expect a market an increase and Put options when you expect a market downturn.

- As a result, the buyer of a call option profits when the market increases, and the buyer of a put option profits when the market decreases.

You have to trade options with the following different strike prices while doing option trading:

- In the Money Option

- At the Money Option

- Out of the Money Option

1.What is CALL Option?

A call option is an agreement that gives the option buyer the right to buy the underlying asset at a predetermined price and within a specific time period.

However, the buyer is under no obligation to buy this option, thus he is not required to do so.

- Underlying assets include equities such as stocks, bonds, commodities, and more.

- When the value of the underlying asset rises, the call option buyer benefits from their investment.

- The striking price is the particular cost at which a call option is bought.

- The expiry date of an option refers to the specific time frame within which it is sold.

- While index expiration is weekly (every Thursday), share option expiration is monthly (last Thursday of each month).

- The premium is the sum you have to pay to buy the option. The highest amount you can lose on a share is this much.

- Using various option trading strategies, one can make money by trading options on the stock market.

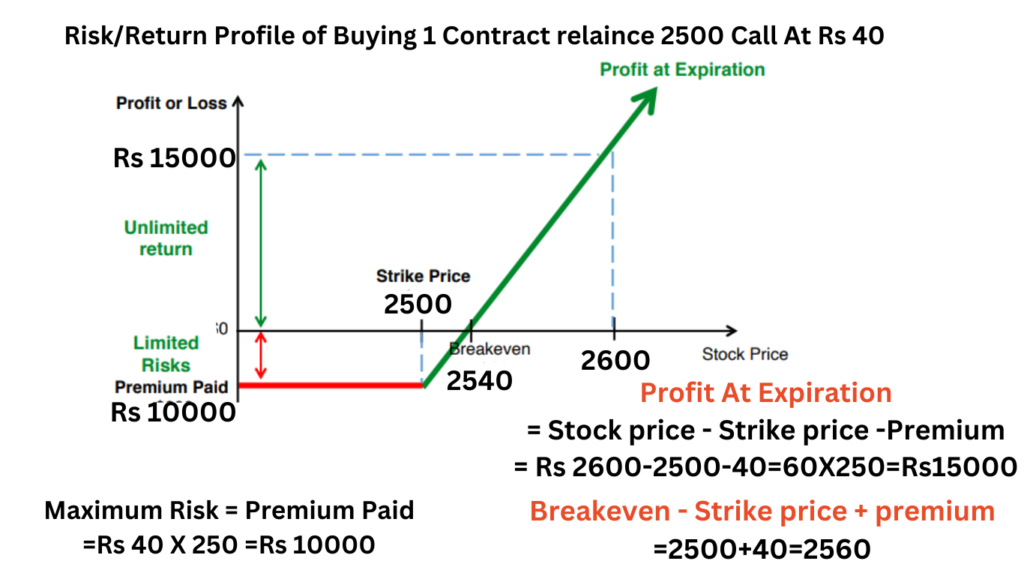

EXAMPLE Of CALL Option: RELIANCE INDUSTRIES

A contract that gives the buyer the option to purchase 250 shares of stock at a certain strike price on or before a particular expiration date.

Relaince Industries Monthly expiry of Sep 2023 Call Option at strike price of 2500, the Premium is 40Rs

2.What is PUT Option:

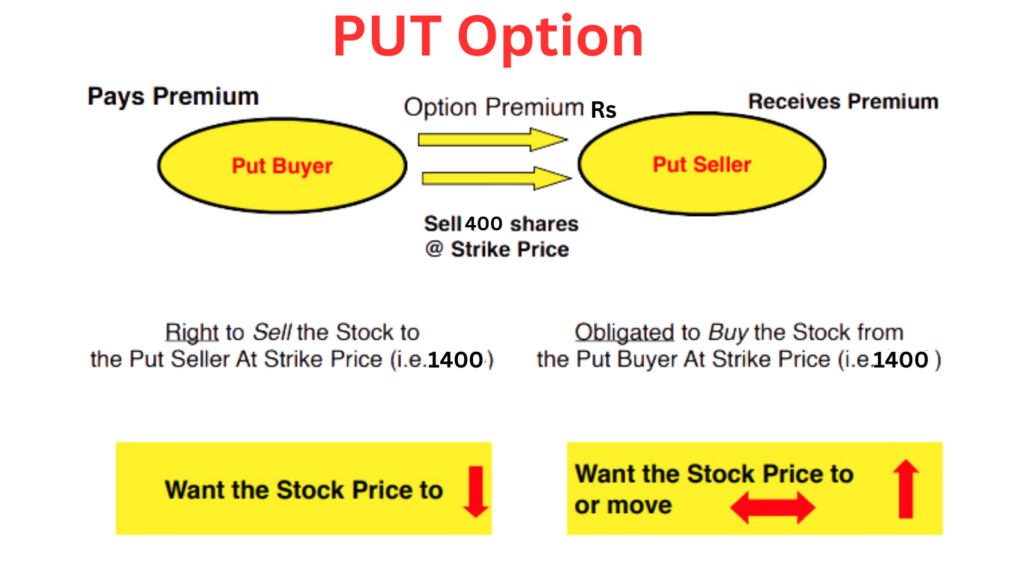

A put option is the exact opposite of a call option. The contract is a financial one as well. It allows the sale of an underlying asset at a particular price and within a particular period of time.

Buying a put option indicates that you are placing a bet on the asset’s downfall.

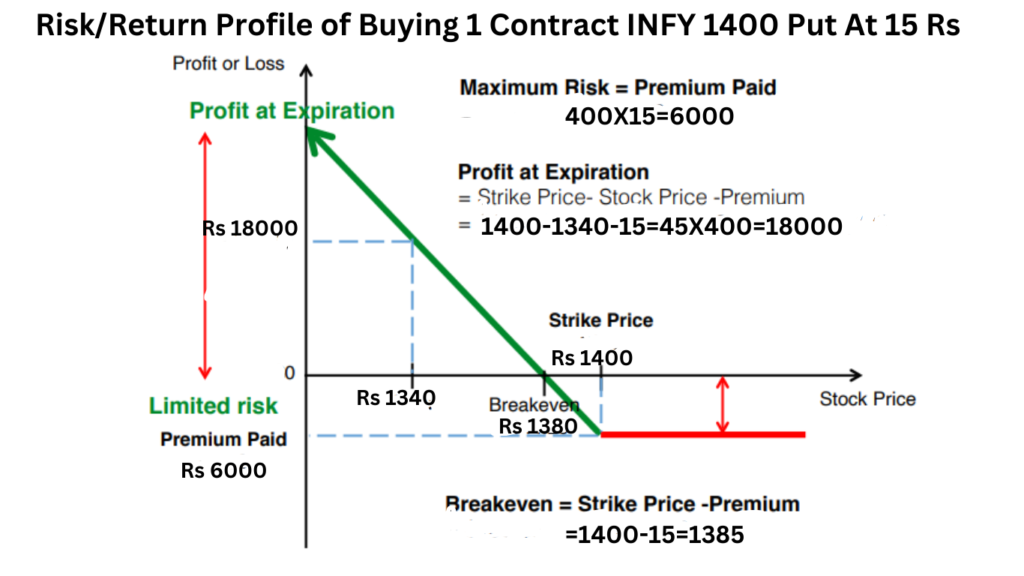

Example of PUT Option: INFOSYS

In a put option, the buyer receives the right to sell 400 shares at the strike price on or before the expiration date.

Infysos Monthly expiry of Sep 2023 PUT Option at strike price of 1400, the Premium is 15Rs

What is the difference between call and put option edelweiss?

- The main difference between the two is that call options should be bought during periods of price increases in stocks, while put options should be bought during periods of declining stock prices.

- Profit occurs when the share price increases by buying a call option, whereas profit is gained when the share price decreases by buying a put option.

- A call option is a contract for betting on the price of a stock increasing, whereas a put option is a contract to bet on the price of a stock decreasing.

- When the market increases, the option seller should sell put options, and when the market is falling, sell call options.

- When the market is in a bull run, it is profitable for an option buyer to buy a call option, and when the market is in a bear run, they need to buy a put option.

- You can also buy calls and puts simultaneously by constructing a spread strategy that significantly reduces your risk tolerance.

- When the market is in a decline, people tend to panic sell more quickly than when it is booming, and they might make significant money by selling puts rather than calls.

call and put option edelweiss?call option and put option?what is call option and put option?difference between call option and put option.

Conclusion:call and put option edelweiss

call and put option edelweiss are powerful instruments that may improve your financial techniques to sum up. Anyone wishing to invest in the complex field of finance has to understand its principles and applications.

Frequently Asked Questions

How do I select whether to buy a call option or a put option?

Before buying a call or put option, you must conduct market research. buy call options if the market is at its support level and is currently rising; buy put options if the market is currently declining and is approaching its resistance level.

What happens after call and put option edelweiss expiration?

The option you bought loses all of its value after the call and put expiration dates. Due to this, you should sell all of your bought option contracts before they expire.

you can read this article as well.

- what is options trading?

- Future and options trading?

- How to select stocks for intraday

- Best indicator for option trading?

- What is Derivatives in Stock Market?

- Best option Trading Books?

However, if you still have any questions about this topic, feel free to leave comments below.

2 Comments on “call and put option edelweiss: Beginers Guide 2023”