STOCK NAME

ASHOK LEYLAND FUNDAMENTAL ANALYSIS

STOCK SYMBOL

ASHOKLEY

INVESTMENT STRATEGY

SHOULD I BUY THIS STOCK ?

1.Different investors have different account sizes, different risk profiles and different portfolio allocations.

2.Whether you should add shares of a particular stock would depend on…

3.Visit there web site to know Company Profile and Products related and market capitalization etc.

QUESTIONS ?

1)Is this a Fundamentally good business?

2)Is the stock fundamentally undervalued and has it retraced to a support level?

3)What type of stock is this ? Large Growth? Predictable? Cyclical? Speculative ? Dividend ? Does FIT into my portfolio allocation.

4)Do I already have a full allocation for this stock in my portfolio?

Company Profile:

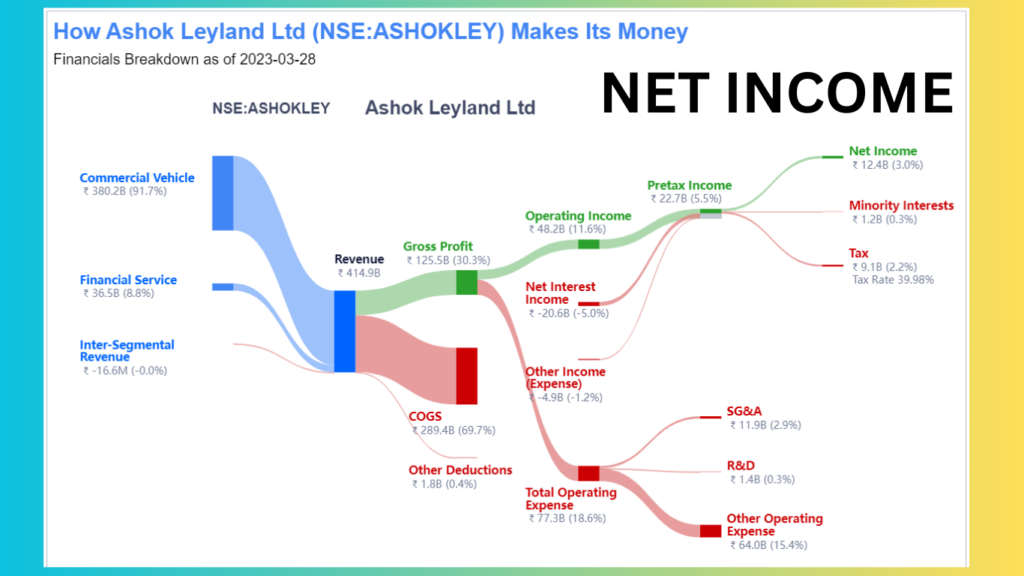

An automobile manufacturer is Ashok Leyland Ltd. The company produces commercial vehicles, engines, spare parts, and accessories, and the sale of commercial vehicles accounts for the vast majority of its income. Commercial vehicles and financial services are how Ashok Leyland divides up its business. More than half of the company’s total revenue is generated domestically.

SECTOR

INDUSTRY

Products:

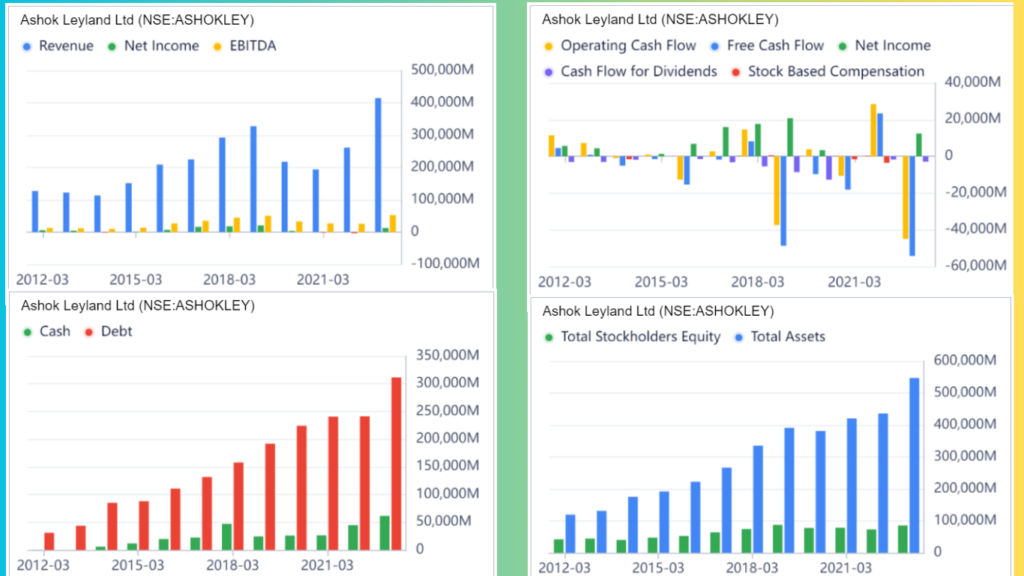

STEP1: (Consistently Increase Sales, Net income & Cashflow)

STEP2: Growth Rate

STEP3: Wide Economic Moat

- In the automotive sector, Ashok Leyland enjoys a strong economic moat and a long-term competitive edge.

- Its market leadership is strengthened by its strong engineering capabilities, extensive distribution network, and cutting-edge product offerings.

- Ashok Leyland solidifies its position as a market leader in commercial vehicles by utilising cutting-edge technology, effective manufacturing, and a customer-centric attitude.

- This unwavering dedication to quality, combined with a thorough after-sales service structure, solidifies its lasting market influence and promotes growth and investor confidence.

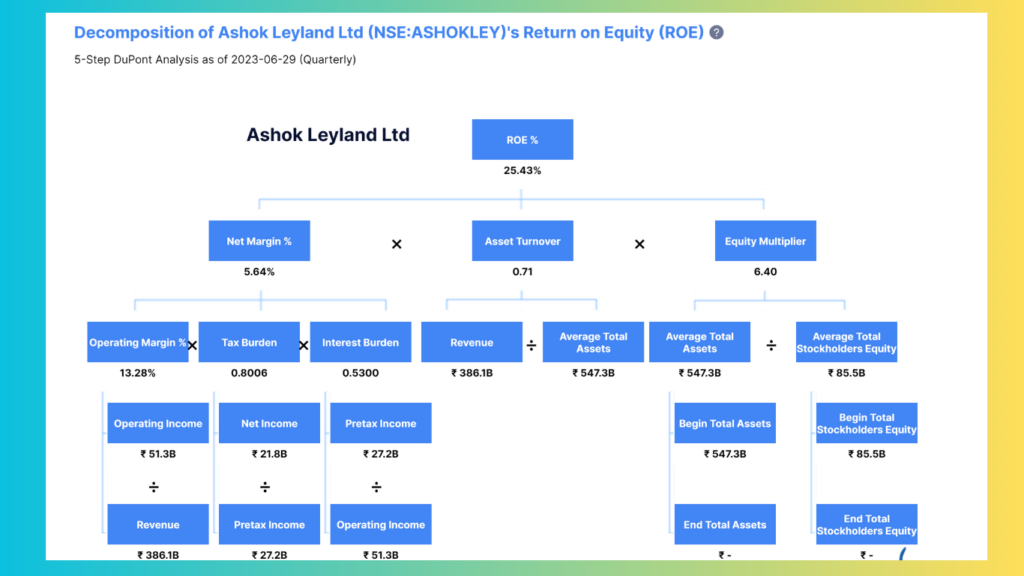

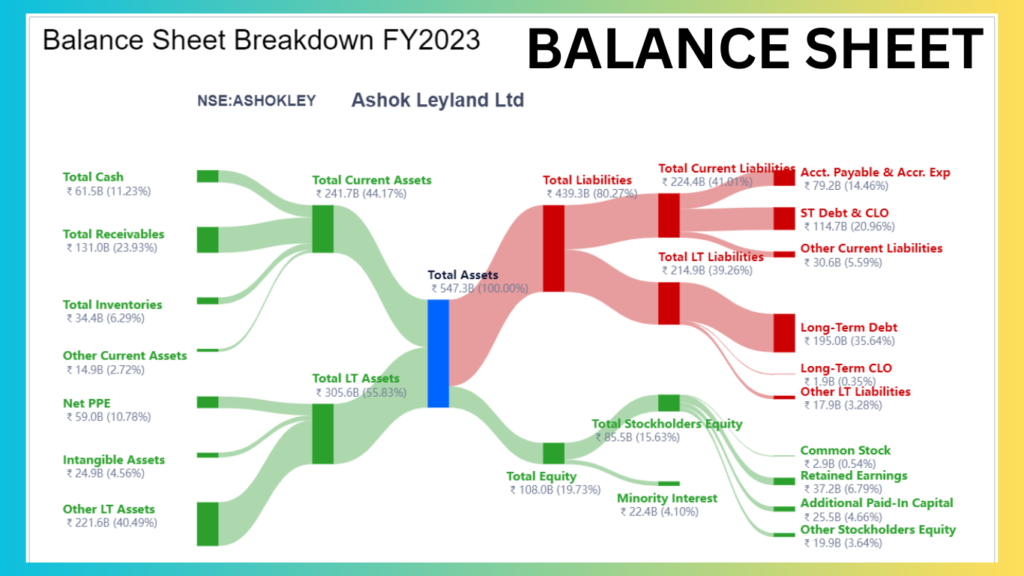

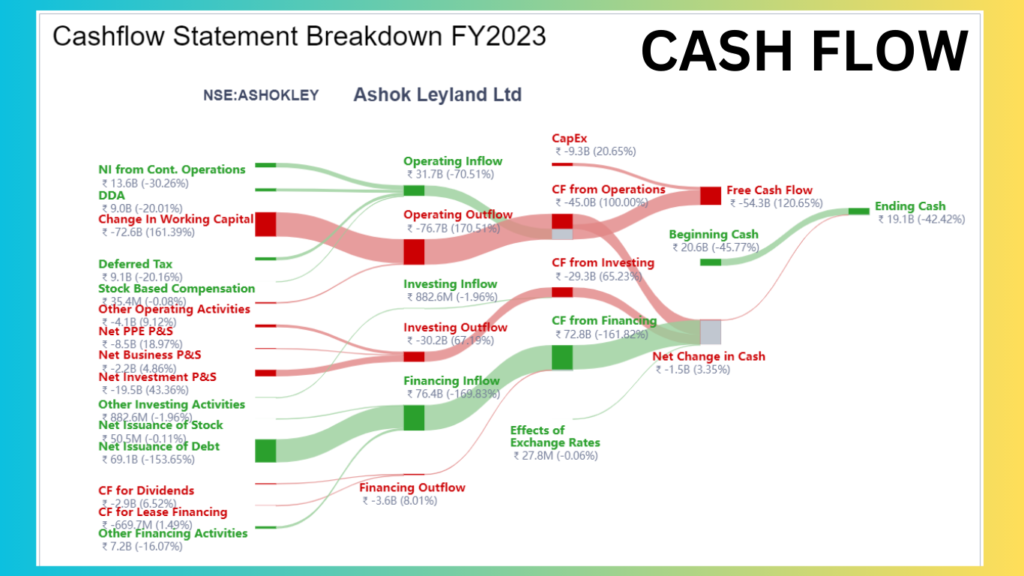

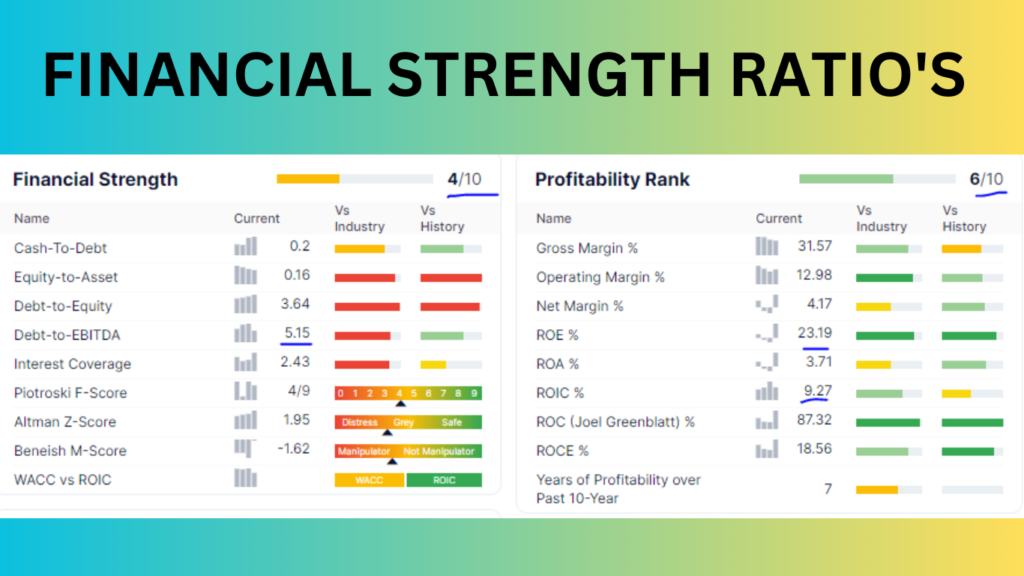

Financial Strength Ratio & Breakdowns of Netincome , Balance Sheet & Cashflow

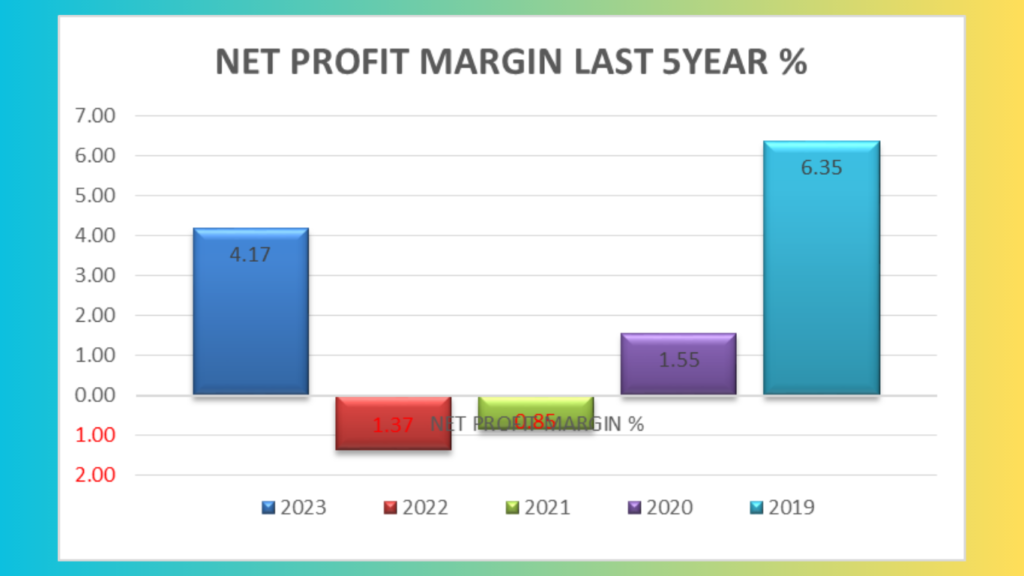

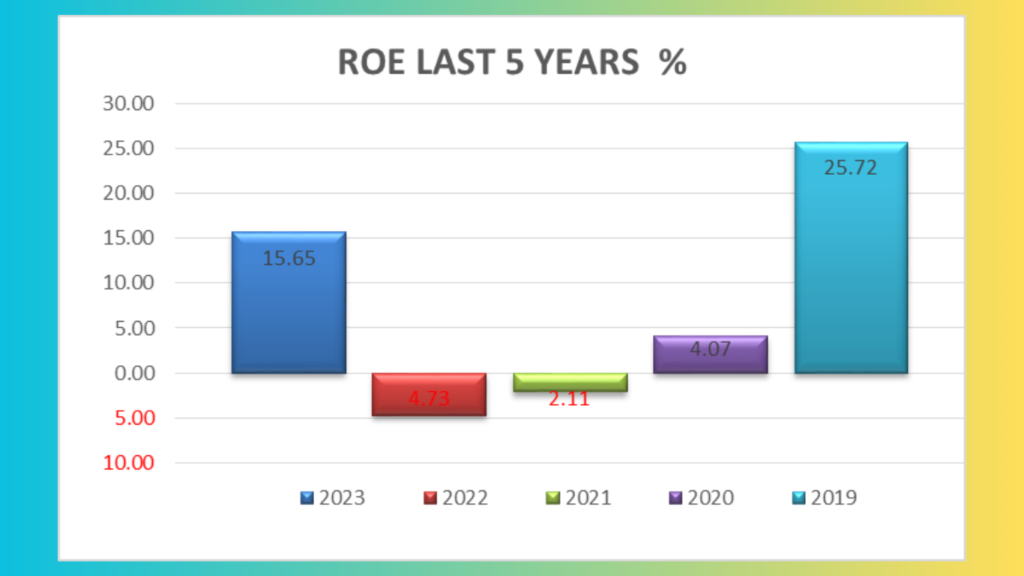

STEP 5: Company Margins

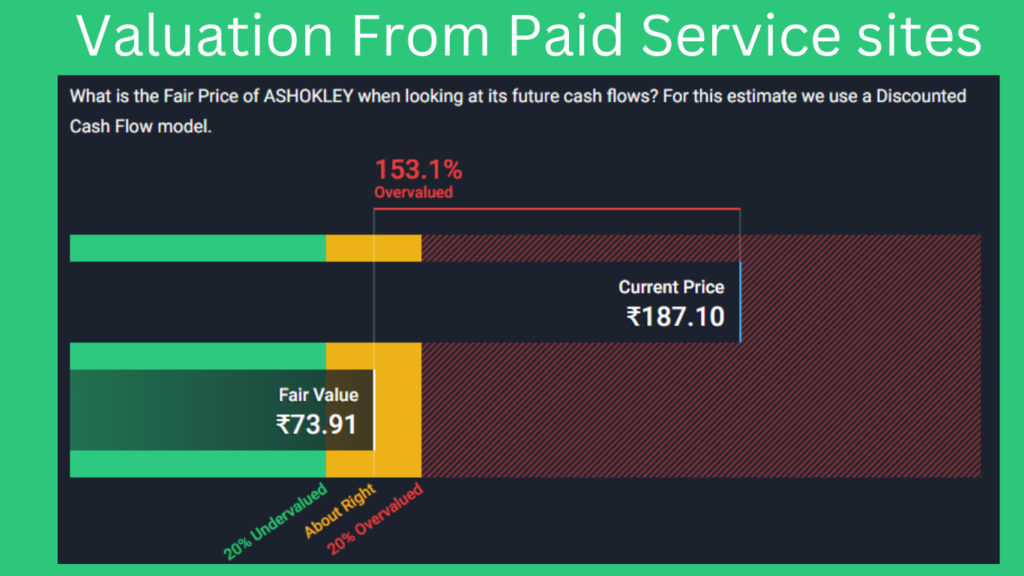

STEP 6: Company Actual Value

STEP 7: Price is Below or Near Intrinsic Value

STEP 8: Is it a Great Point of Entry

- Company Actual Value of ASHOKLEY paid websites given fair value is 73.91 and one more website given 218Rs .

- Shark Invetsments Pair value is 170Rs .

- The Average of three fair value is 154 RS

- ASHOKLEY (187.1) is trading above our estimate of fair value (154), which is below fair value.

- ASHOKLEY is trading above our estimate of fair value, which is a significant over price from value.

For Trading right now, its great time to enter for short term with small stop loss. The stop loss is below 168Rs. The entry point is 170 -185 in between. The Target price is 1:2 Risk Reward Ratio.

STEP 9: Final Note

The fundamental study of Ashok Leyland indicates favourable characteristics including steady net income growth, but also irregular cash flow, sporadic negative cash flow, and a significant amount of debt. These elements fit the first-step failure criteria established by Shark Investments. Additionally, the margins fall short of Shark Investments’ requirements and the positive growth rate deviates from the five-year average’s negative trend. But from a technical standpoint, the stock satisfies the requirements after breaking the 5-year cup pattern with rising trade volume. This shows the potential for shorter-term trades, but given the larger structural factors, long-term investment seems less prudent.

Company DEBT NOTE: Very High Debt, It is not suitable to invest for longterm investment

- Debt Level: The net debt to equity ratio of ASHOKLEY (231.6%) is regarded as excessive.

- Debt reduction: Over the last five years, ASHOKLEY’s debt to equity ratio has risen from 192.9% to 288.6%.

- Debt Coverage: Because of ASHOKLEY’s negative operating cash flow, debt is not adequately covered.

- Interest Coverage: ASHOKLEY’s EBIT only provides 2.3 times the amount needed to pay interest on its debt.