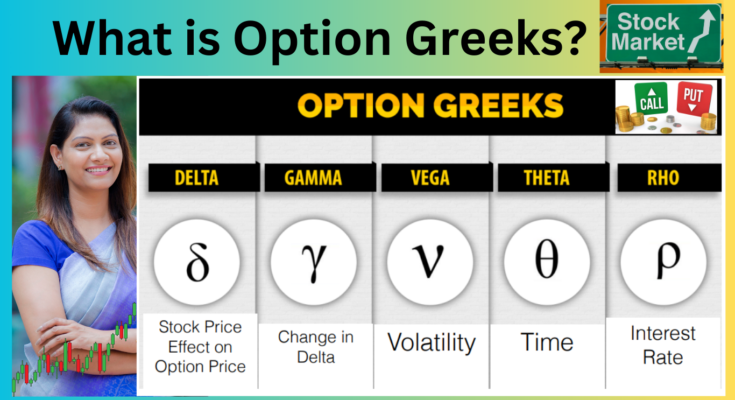

Option Greeks. These two terms are the secret to understanding the complex area of options trading. Understanding the importance of Option Greeks is your first important step if you’re entering the thrilling world of stock market investments.

Find the way option Greeks can be used to evaluate the rewards and risks of options contracts.

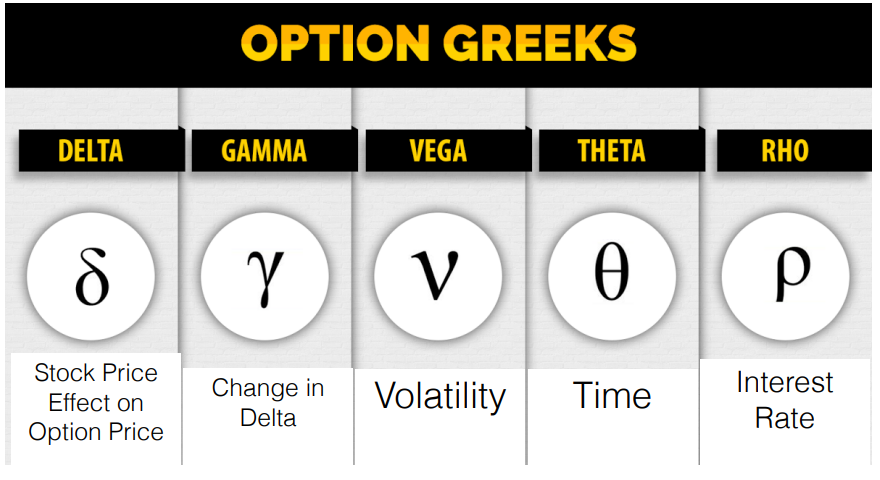

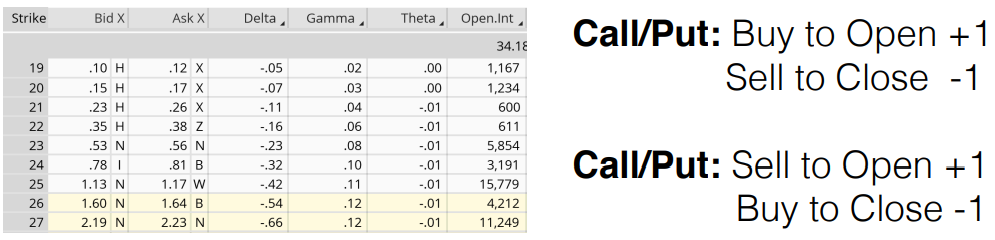

Let’s start with the fundamentals before getting into the complex nature of Option Greeks. Greeks are a set of factors that are used to quantify and evaluate the risks and benefits related to trading options. These factors, which also include the names Delta, Gamma, Theta, and Vega, are essential in determining an option’s price, risk exposure, and overall performance.

Table of Contents

What are Option Greeks?

Greeks measure all the things that affect an option premium

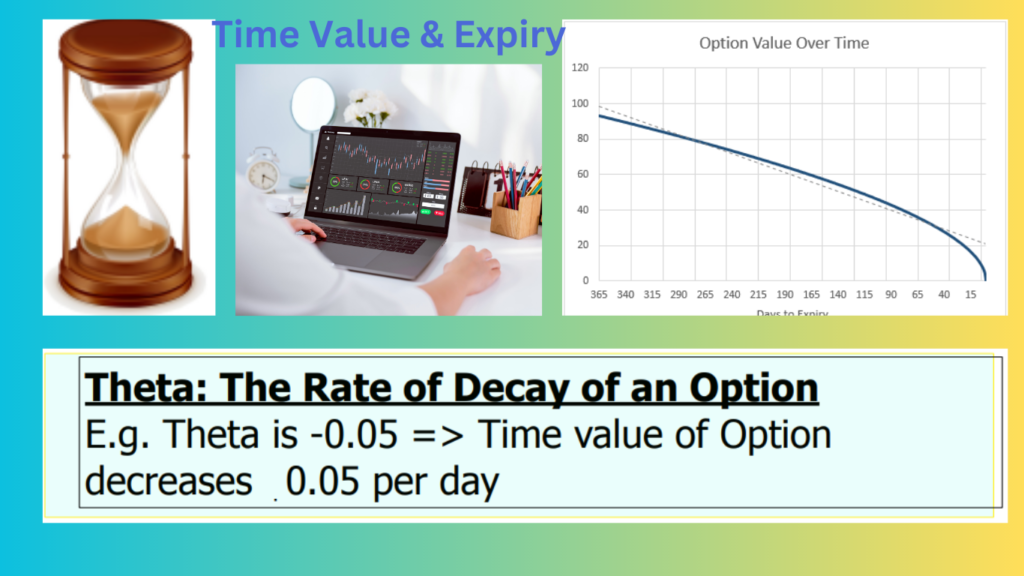

Theta:Time Value & Expiry

Time Value decreases exponentially as time passes

⇒ Buy Options with Different Times to Expiration (days to 3 years)

⇒ Further the expiration date, more time value, the higher the premium

• At expiration, Option Price = Intrinsic Value (Time Value = Rs 0)

• Time value decays the fastest during last 30-60 days => Sell Options 30- Days Before Expiration

• Monthly Options Expire FOURTH THURSDAY of the Month.

Option Expiration Dates:

All Options have Fixed Expiration Dates

• Weekly Options

Expire on the Thursdayday of Every Week

• Monthly Options

Expire on every month last weak of Thursday

Most liquid. Best bid/ask spreads

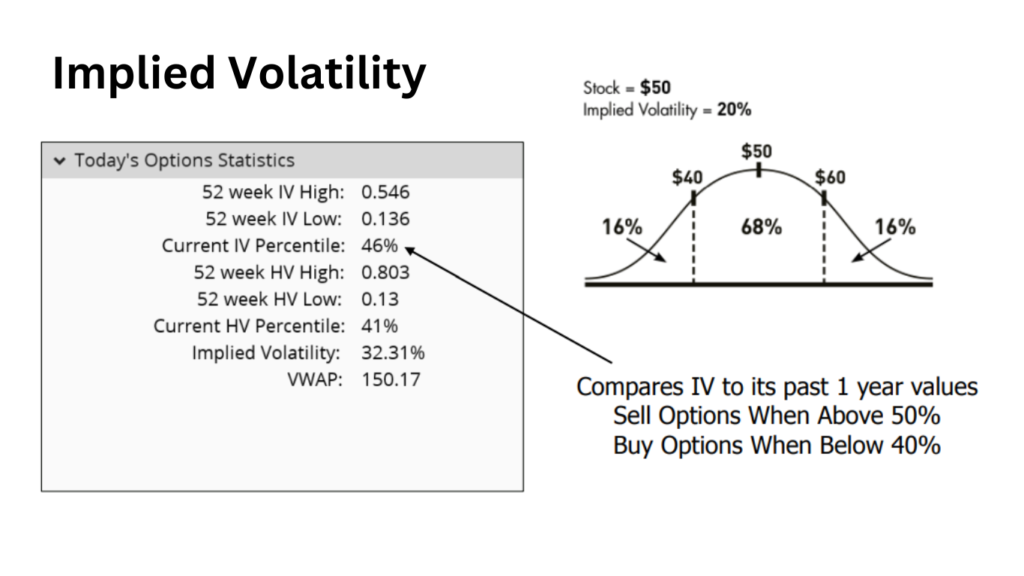

VEGA:Volatility & Vega

Volatility Makes up a large part of Extrinsic Value

• The price of the options increases with a stock’s amount of volatility.

• Volatility tends to increase during major news events (Earnings, FOMC etc..)

• When volatility is low (cheap), buy options.

• When volatility is high (expensive), SELL options.

Implied Volatility (IV):

• Calculated volatility value derived from option market pricing

•according to an Options Pricing Model (eg. Black Scholes model)

• IV shows where the market place views the volatility in the future

• It implies a magnitude of the underlying stock price move within 1 year with 1-SD probability.

Vega measures option premium change due to a 1% move in Implied Volatility (IV)

•Example: An option has a value of Rs1.50; Vega is showing 0.1. If IV moves from 20% to 21%, the option value will increase to Rs 1.60

• The higher the Vega, the further away from expiration.

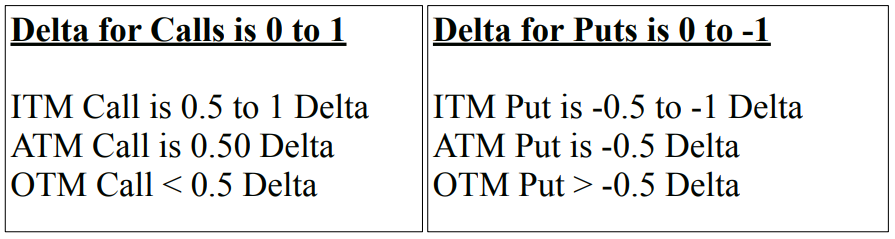

DELTA: Measure the option price

• Delta is the change in the option price relative to the change in the underlying stock price

• Delta of 0.80 (80 Deltas) => Option price increases Rs 0.80 for every Rs 1 increase in the stock price.

The Delta is also the probability that the Option will be ITM at Expiration

Gamma – Premium Acceleration

• Measures change in Delta due to a Rs 1 move in underlying stock price

• Also known as Delta of Delta

• Gamma is highest when option is ATM

• Gamma increases the closer to expiration

Open Interest

• The total number of active option contracts, or those who have been traded but have not yet been closed, exercised, or assigned.

• The Open Interest number does not change throughout the day but improves itself before the next day once the trades are added up.

Frequently Asked Questions?

Are the Options Greeks applicable to all options?

Absolutely. The use of option Greeks is required for trading all types of options, including call and put options.

Is it required to manually calculate the Option Greeks?

Even while it’s useful to know how to calculate option Greeks manually, many trading platforms and tools give traders access to real-time Greek values, which is helpful.

How can I learn more about Option Greeks?

Option Greeks are the subject for many books, online courses, and other educational materials. To get experience, you may also think about practising with a virtual trading account.

Are profits in options trading guaranteed by option Greeks?

Option Greeks are tools that help you make better decisions, but they don’t ensure success. An effective options trading strategy combines expertise, strategy, and market research.

Can I use option Greeks in markets outside stocks in the financial world?

yes, Option Greeks do indeed apply to a variety of financial markets, including those for commodities and foreign exchange. Any asset class trader can gain from knowing these Greeks.

you can read this article as well.

- what is options trading?

- Future and options trading?

- What is volume in stock market?

- How to earn 1 lakh per day from share market?

- Best stocks to trade in stock market?

- How to select stocks for intraday?

- Best indicator for option trading?

Conclusion

Option Greeks are your keys to opening knowledge in the field of stock trading, where knowledge actually is power. These tools offer priceless insights into how options behave and the risks they carry. You may control risk, improve your entire trading strategy, and make educated decisions by learning and using Delta, Gamma, Theta, and Vega. The next time you’re getting ready for a trading experience on the stock market, keep in mind the magic words: “Option Greeks.”

I really hope that you found the content to be beneficial. If you have any questions about this article, please leave a comment below.

4 Comments on “Option Greeks: The 5 Risk-Measuring Factors”