STOCK NAME

PI INDUSTRIES FUNDAMENTAL ANALYSIS

STOCK SYMBOL

PIIND

INVESTMENT STRATEGY

SHOULD I BUY THIS STOCK ?

1.Different investors have different account sizes, different risk profiles and different portfolio allocations.

2.Whether you should add shares of a particular stock would depend on…

3.Visit there web site to know Company Profile and Products related and market capitalization etc.

QUESTIONS ?

1)Is this a Fundamentally good business?

2)Is the stock fundamentally undervalued and has it retraced to a support level?

3)What type of stock is this ? Large Growth? Predictable? Cyclical? Speculative ? Dividend ? Does FIT into my portfolio allocation.

4)Do I already have a full allocation for this stock in my portfolio?

Company Profile:

Agrochemicals, specialised fertilisers, and seeds are all products that PI Industries Ltd. produces, distributes, and sells to the agricultural sector. Insecticides, fungicides, and plant health products are included in the company’s portfolio of agrochemicals. The business competes on pricing with businesses that produce and market generic goods. Within India and outside India are the two sales segments that PI Industries reports. Outside of India, the company’s business operations are mostly divided between China, Germany, and Japan. The company uses a broad network of retailers and distributors to market its goods in India.

SECTOR

INDUSTRY

Products:

STEP1: (Consistently Increase Sales, Net income & Cashflow)

STEP2: Growth Rate

STEP3: Wide Economic Moat

- PI Industries Ltd. has a strong economic moat that is reinforced by long-term competitive advantages.

- Years of research and development have helped its cutting-edge agrochemical and bespoke manufacturing departments build a deep level of knowledge.

- This knowledge-intensive strategy creates a barrier to entry because it is difficult to duplicate their complex methods.

- The company’s extensive distribution network strengthens its moat and allows for effective supply chain management and a broad reach. Additionally, PI Industries’ dedication to innovation encourages the creation of new products, retaining its competitive advantage.

- These interrelated advantages give PI Industries a competitive edge over the competition by protecting it from market volatility and establishing it as a tenacious and powerful player.

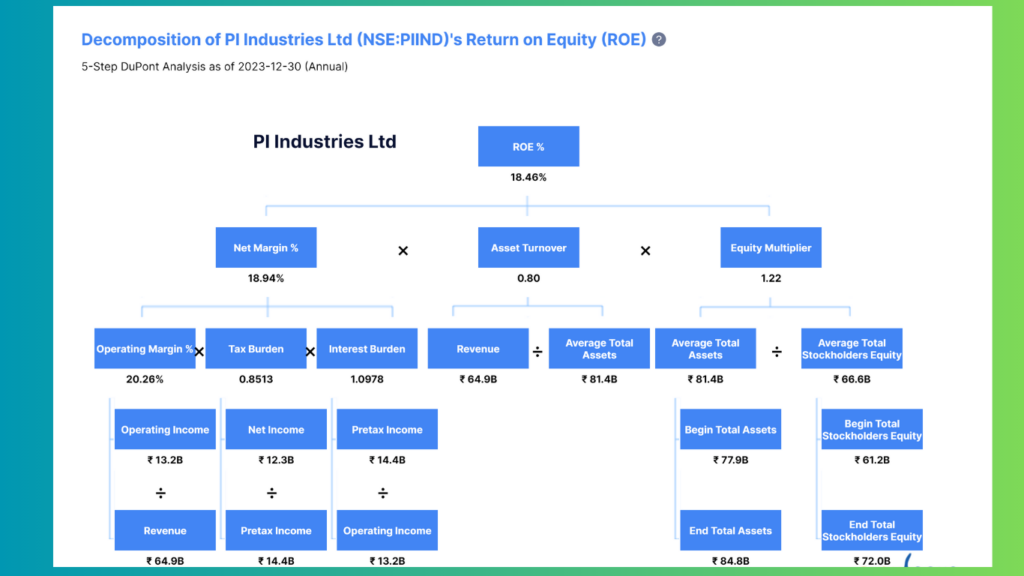

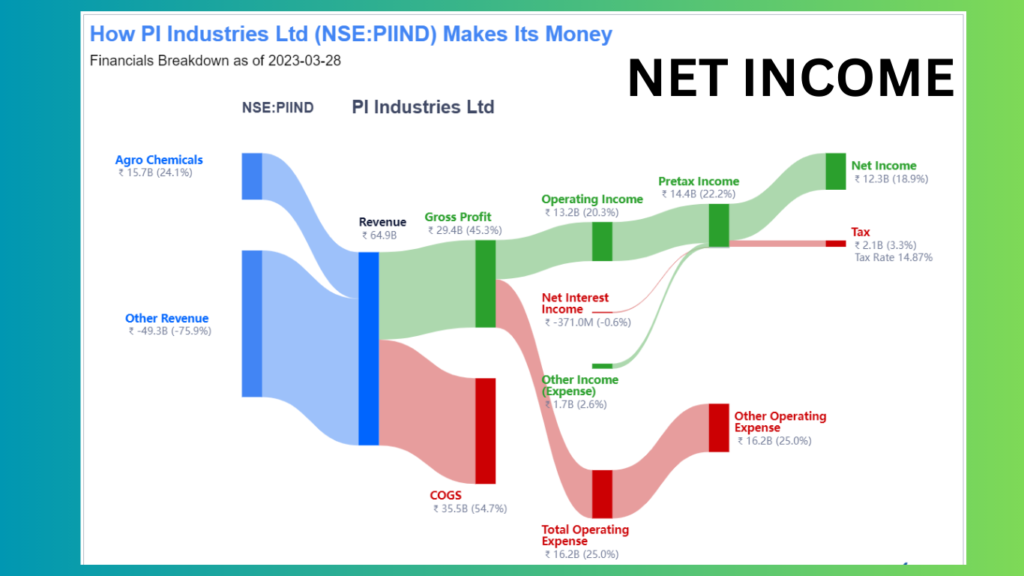

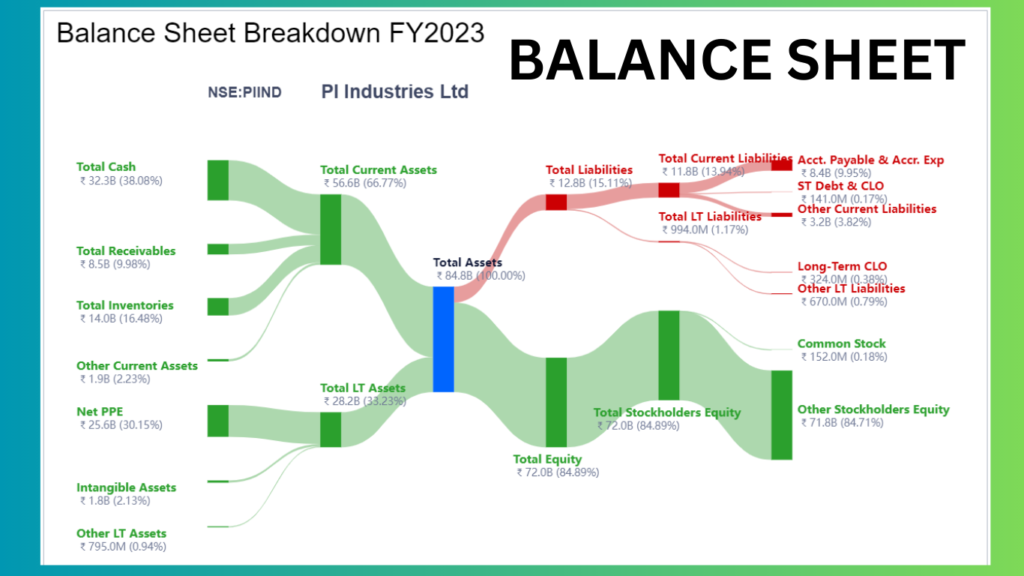

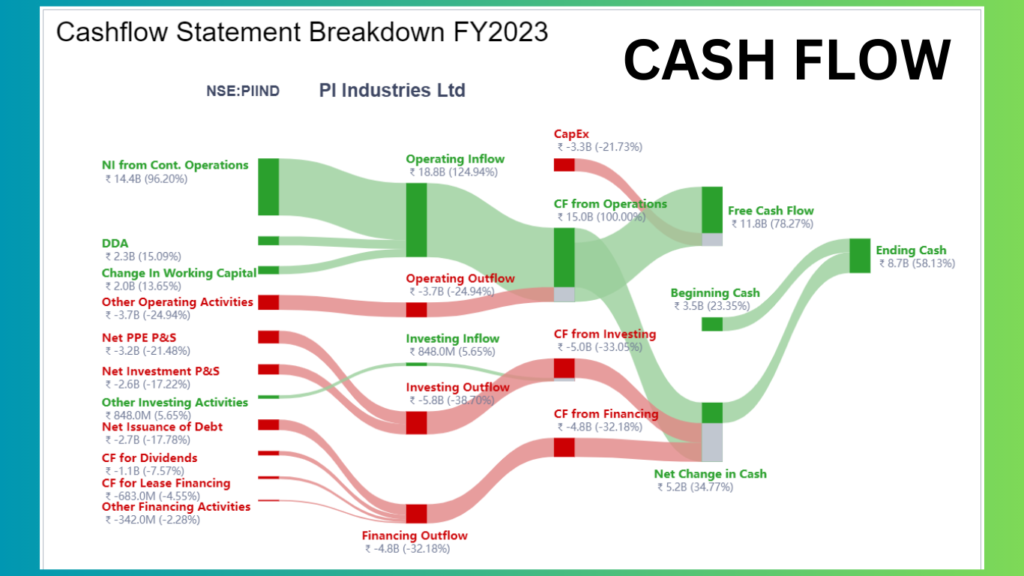

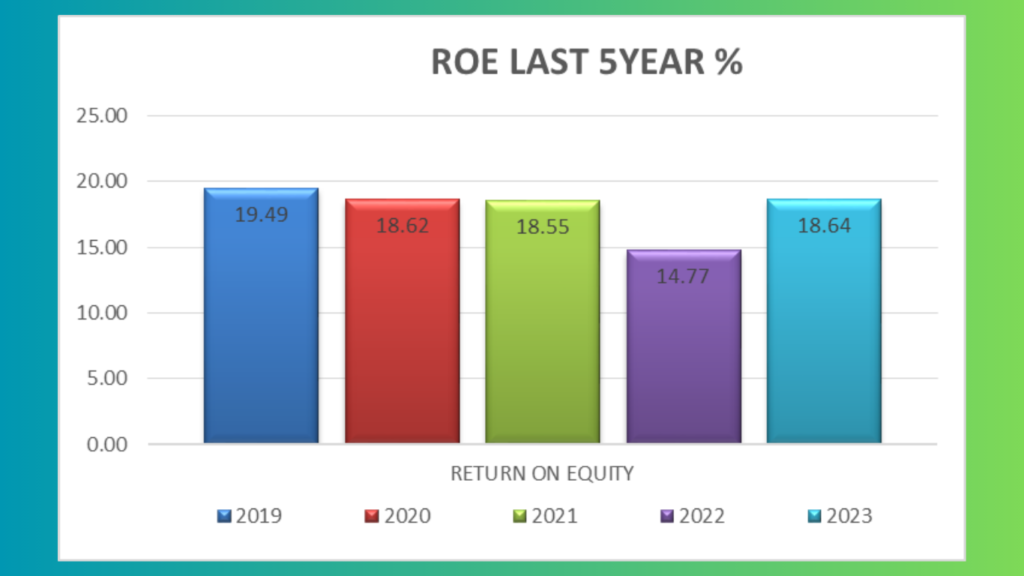

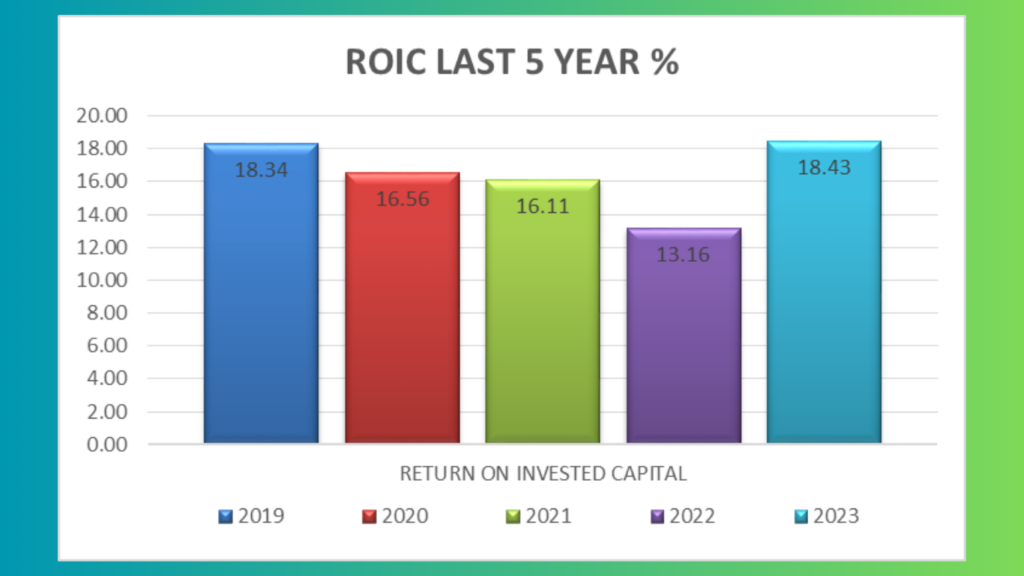

Financial Strength Ratio & Breakdowns of Netincome , Balance Sheet & Cashflow

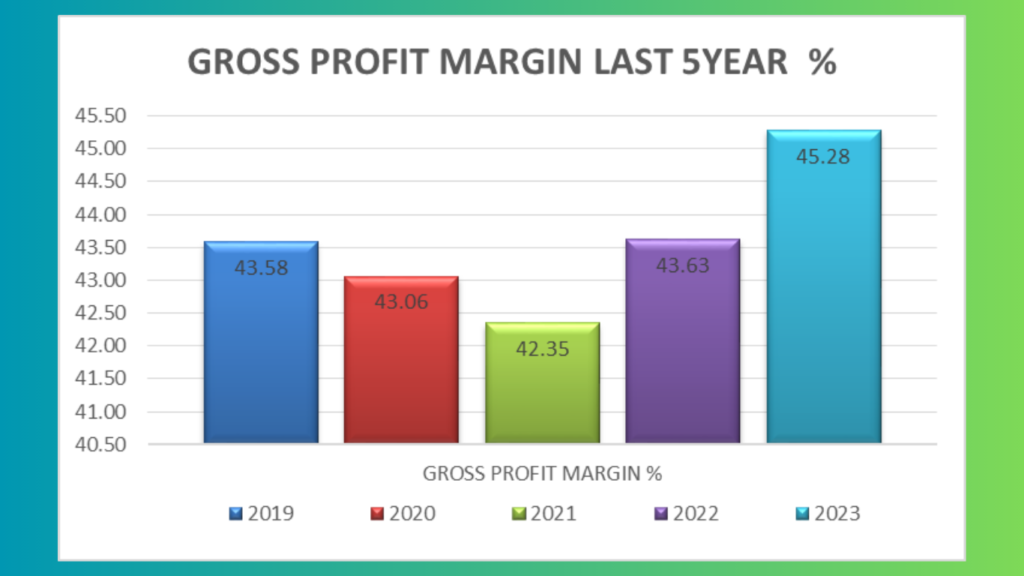

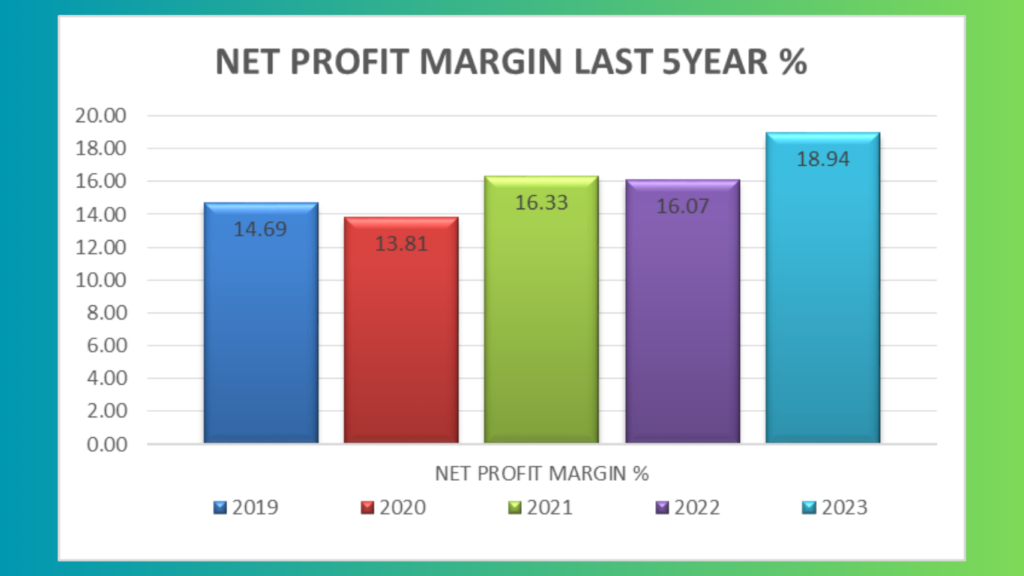

STEP 5: Company Margins

STEP 6: Company Actual Value

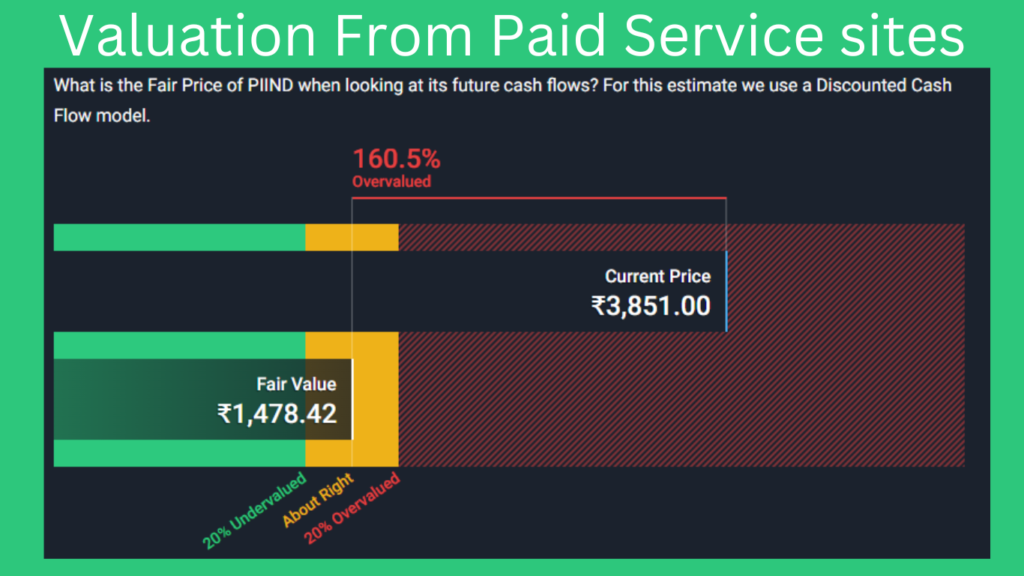

STEP 7: Price is Below or Near Intrinsic Value

STEP 8: Is it a Great Point of Entry

Yes, Its Right time to enetr at current market price. If we observe very zero debt comapny, positive cash flow then what we need and one more is all financial ratios passes our criteria. Go ahead without worries for long term investment.

STEP 9: Final Note

PI Industries stands out in both technical and fundamental evaluations. It satisfies our Shark Investments requirements thanks to strong sales and steadily rising cash flow over the previous five years. With low debt and solid cash flow, the balance sheet is healthy. The stock is well-positioned from a technical perspective, initially entering at the current trading price. The market price is currently below Shark Investments’ estimate of fair value. With PI Industries, you may invest with confidence because the company has strong fundamentals and a favourable technical outlook.