STOCK NAME

EXIDEIND FUNDAMENTAL ANALYSIS

STOCK SYMBOL

EXIDEIND

INVESTMENT STRATEGY

SHOULD I BUY THIS STOCK ?

1.Different investors have different account sizes, different risk profiles and different portfolio allocations.

2.Whether you should add shares of a particular stock would depend on…

3.Visit there web site to know Company Profile and Products related and market capitalization etc.

QUESTIONS ?

1)Is this a Fundamentally good business?

2)Is the stock fundamentally undervalued and has it retraced to a support level?

3)What type of stock is this ? Large Growth? Predictable? Cyclical? Speculative ? Dividend ? Does FIT into my portfolio allocation.

4)Do I already have a full allocation for this stock in my portfolio?

Company Profile:

An Indian company called Exide Industries Ltd produces batteries that are sold under the Exide name. The business provides batteries for automakers based in India, such as Mitsubishi, Hyundai, Honda, Toyota, Fiat, Renault, GM, Mahindra, Tata, Bajaj, Suzuki, and Hero, as original equipment and aftermarket parts. Exide Industries also supplies batteries to the railroads, mining, computer, telecommunications, infrastructure, power, and defence industries. Storage batteries and related goods and Other are the market segments in which it operates. The majority of the business’s revenue is produced in India.

SECTOR

INDUSTRY

Products:

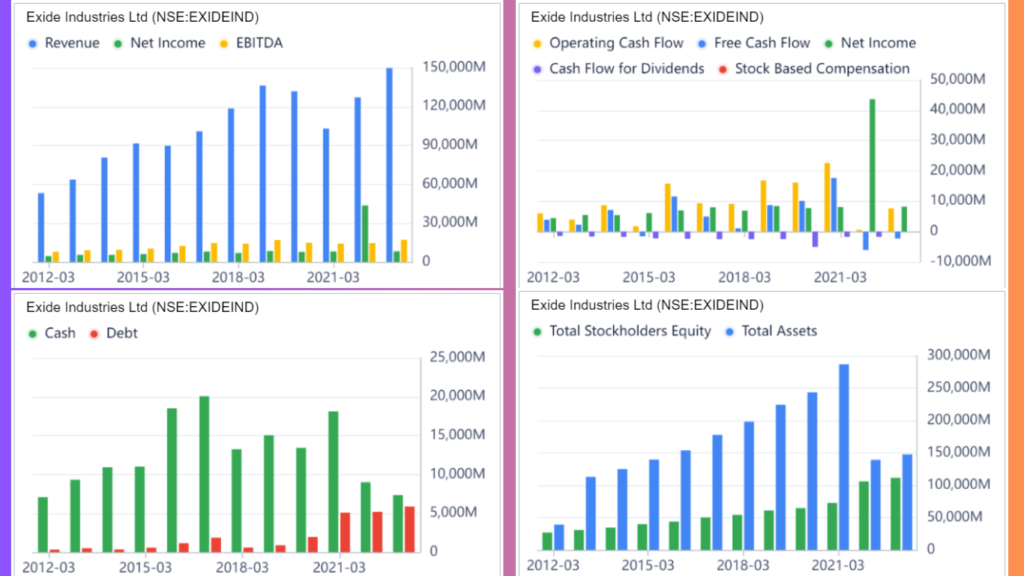

STEP1: (Consistently Increase Sales, Net income & Cashflow)

STEP2: Growth Rate

STEP3: Wide Economic Moat

- Exide Industries’ strong vertical integration, which covers battery manufacturing from raw materials to finished goods, has helped the company gain a durable competitive edge.

- This connection improves supply chain agility, quality assurance, and cost effectiveness. Additionally, the business’ substantial research and development efforts have produced cutting-edge, environmentally friendly battery technology, encouraging environmental responsibility and legal compliance.

- Exide’s extensive distribution network guarantees fast delivery to customers, and its reputable brand upholds their loyalty and trust.

- Combining these elements strengthens Exide Industries’ competitive edge by providing a practical, ecologically friendly, and customer-focused strategy in the fiercely competitive battery market.

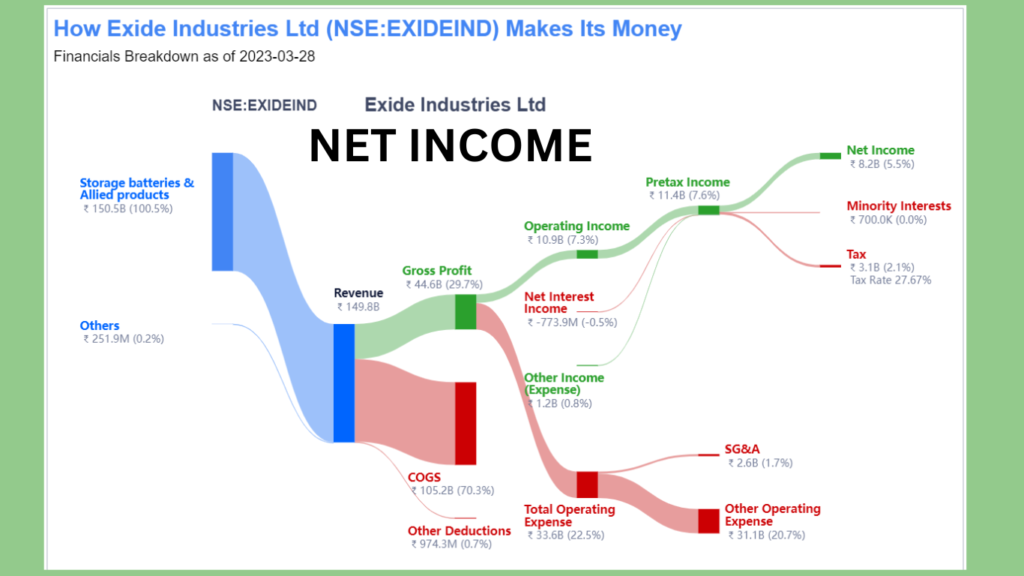

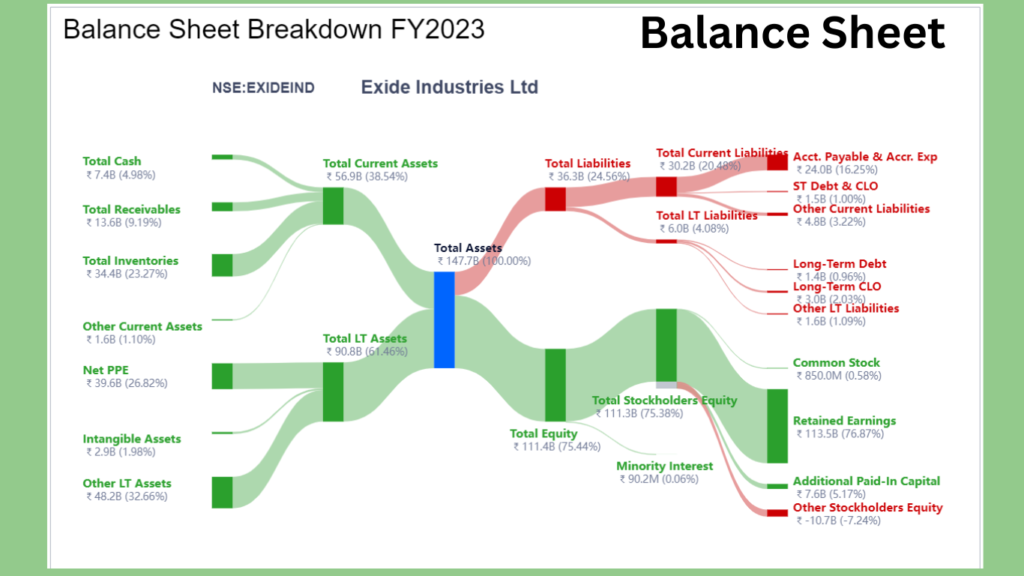

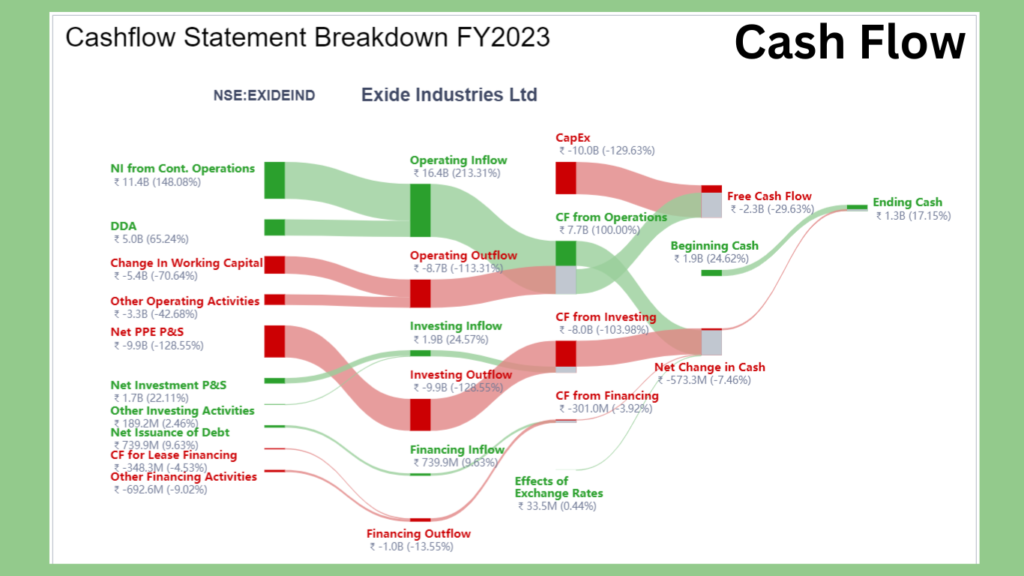

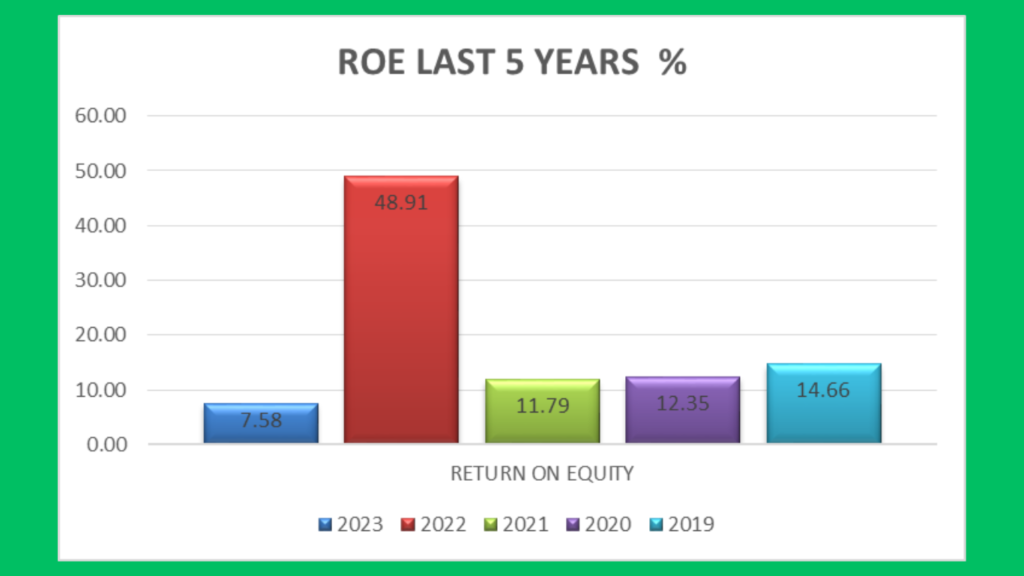

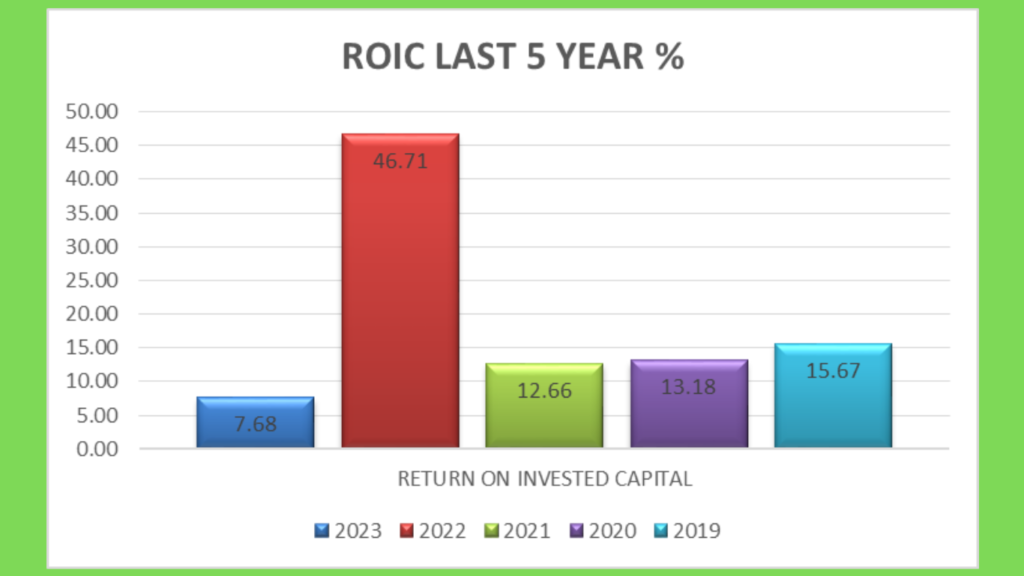

Financial Strength Ratio & Breakdowns of Netincome , Balance Sheet & Cashflow

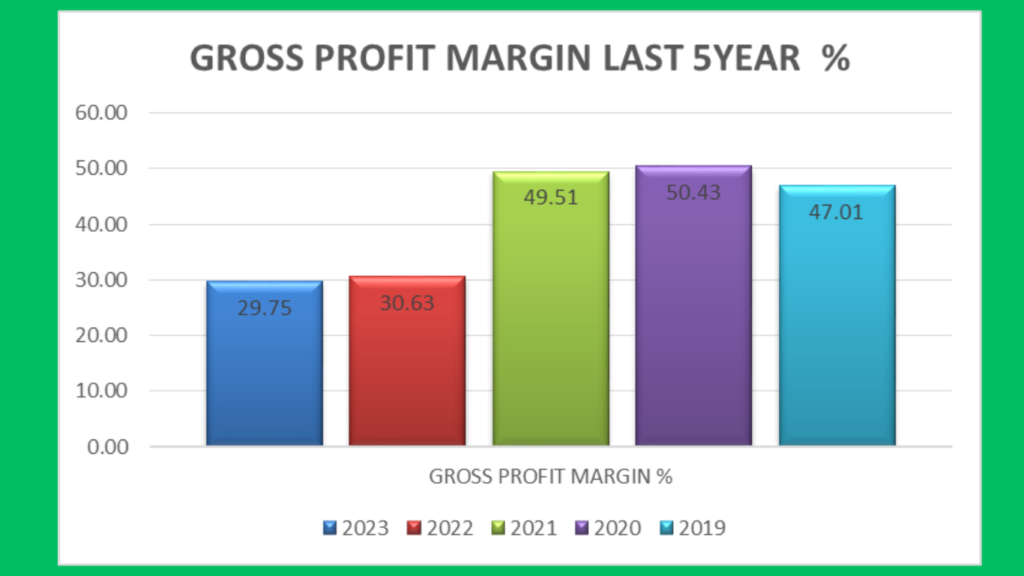

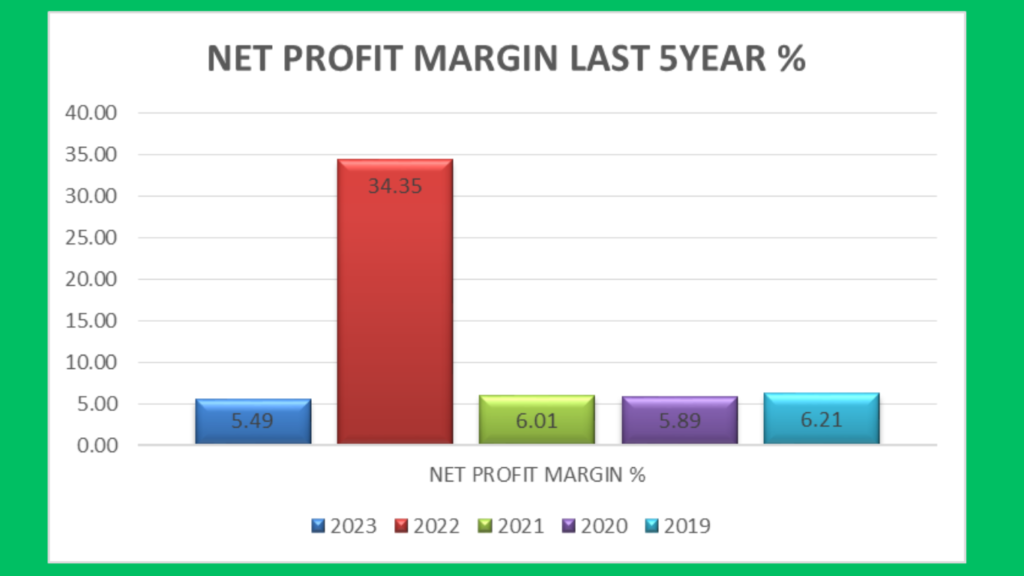

STEP 5: Company Margins

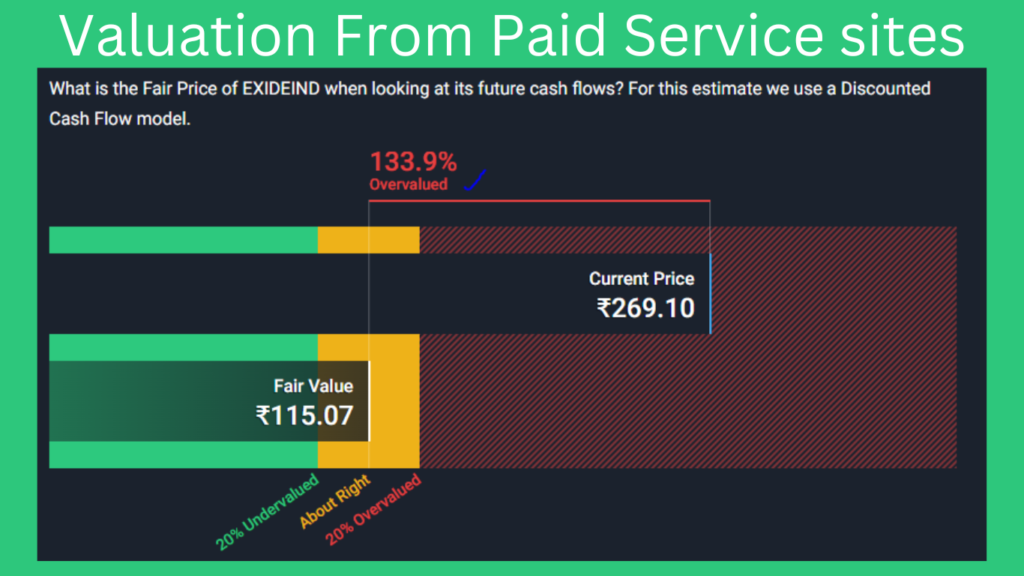

STEP 6: Company Actual Value

STEP 7: Price is Below or Near Intrinsic Value

STEP 8: Is it a Great Point of Entry

As per funadamnetal Analysis, EXIDEIND doing well. It passes our all steps but comapny netprofit margin is very low. As per technical Analysis passes our criteria as well. we can enter at 250Rs and target is 400Rs.

DEBT STRUCTURE OBSERVATIONS:

- Debt Level: EXIDEIND is better off financially than it is in debt.

- Debt reduction: Over the last five years, EXIDEIND’s debt to equity ratio has risen from 1.2% to 5.3% (it is considerable because company having more cash).

- Debt Coverage: Operating cash flow (130.6%) is sufficient to pay off EXIDEIND’s debt.

- Interest Coverage: EBIT (17.1x coverage) more than covers EXIDEIND’s interest payments on its debt.

STEP 9: Final Note

- As per some paid service websites fair values are 115 and 199

- Shark Investments fair value is 300Rs.

- The Final Average of three Fair value is 204.

- Any how as per shark investments its selling at discount, we trust ourvaluation. we can invest into EXIDEIND for Long term investments.

- As per shark Investments passes our fundamental and technical analysis. go ahead without worries.