STOCK NAME

Tcs Fundamental Analysis and tcs share price 2023

STOCK SYMBOL

TCS

INVESTMENT STRATEGY

SHOULD I BUY THIS STOCK ?

1.Different investors have different account sizes, different risk profiles and different portfolio allocations.

2.Whether you should add shares of a particular stock would depend on…

3.Visit there web site to know Company Profile and Products related and market capitalization etc.

QUESTIONS ?

1)Is this a Fundamentally good business?

2)Is the stock fundamentally undervalued and has it retraced to a support level?

3)What type of stock is this ? Large Growth? Predictable? Cyclical? Speculative ? Dividend ? Does FIT into my portfolio allocation.

4)Do I already have a full allocation for this stock in my portfolio?

Company Profile:

With nearly 450,000 employees worldwide, Tata Consultancy Services is a top provider of IT services. The Mumbai-based IT services provider sources half of its revenue from North America by utilising its offshore outsourcing model. Traditional IT services are provided by the company, including consultancy, managed services, cloud infrastructure services, and business process outsourcing as a service (BPaaS).

SECTOR

INDUSTRY

Products:

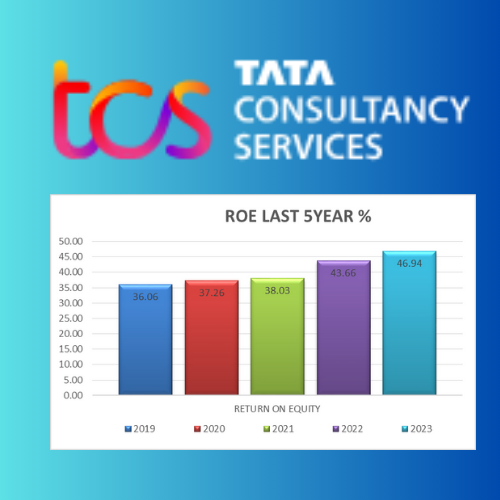

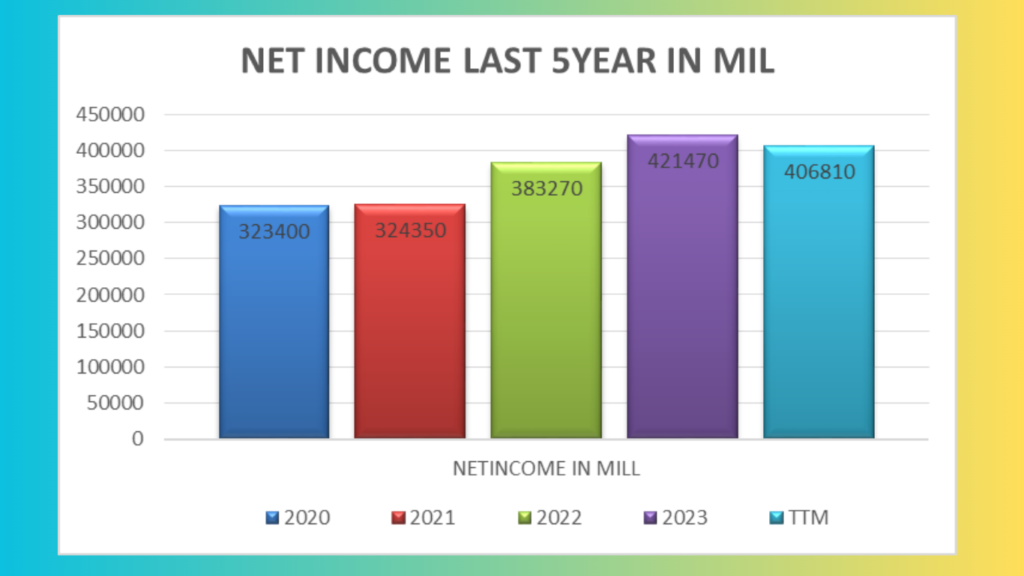

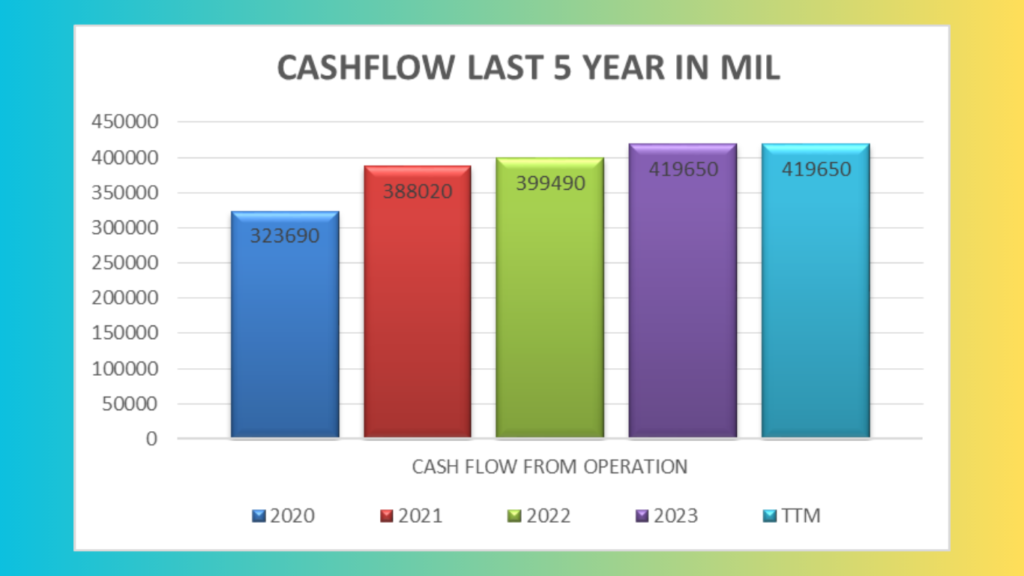

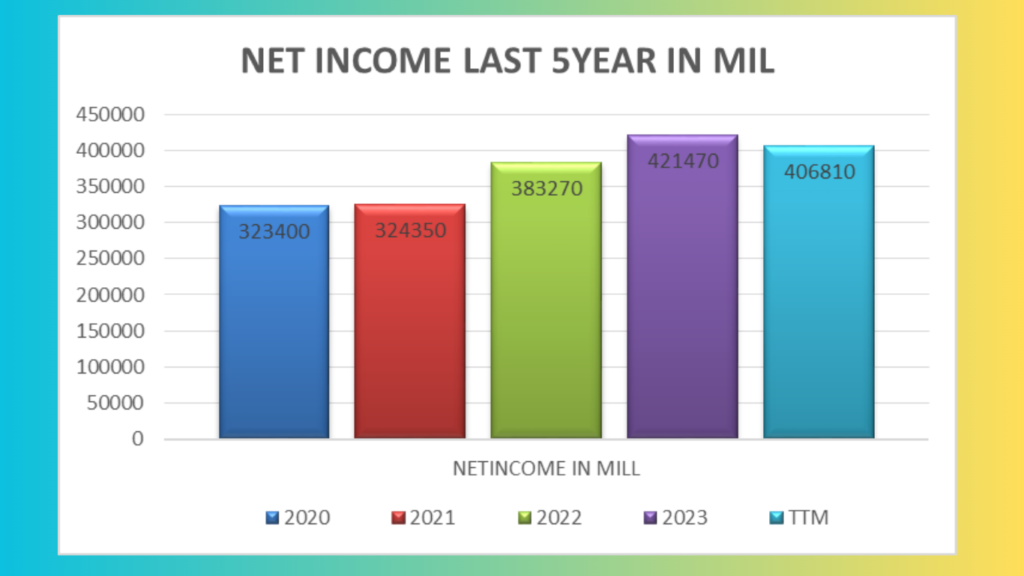

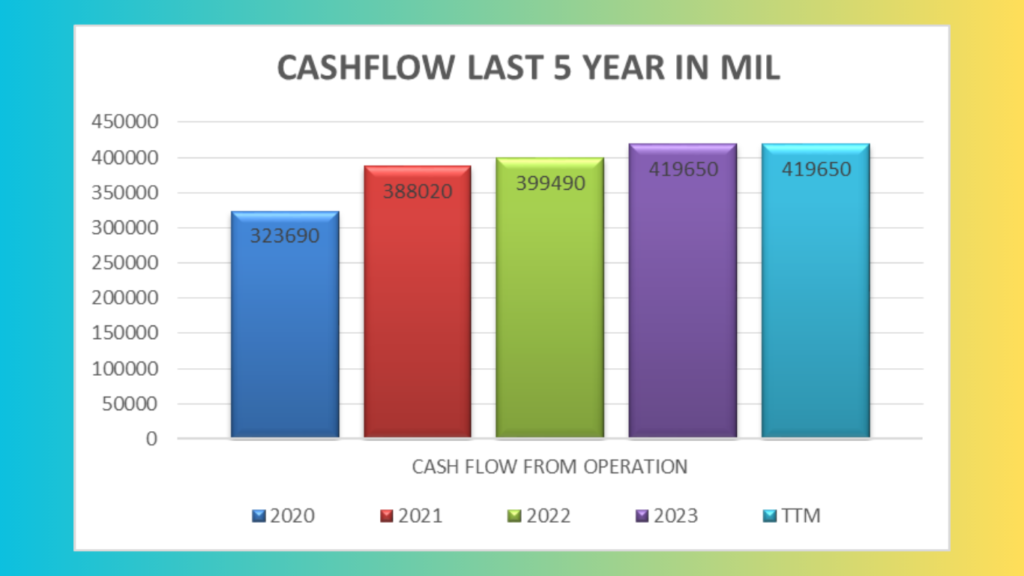

STEP1: (Consistently Increase Sales, Net income & Cashflow)

STEP2: Growth Rate

STEP3: Wide Economic Moat

Tata Consultancy Services (TCS) is a top provider of IT consulting and services globally. It has a large economic moat and long-lasting competitive advantages that have played a role in its long-term success. The following bullet points highlight the competitive advantages and economic moat of TCS fundamental analysis:

Global Scale and Reach: With operations in more than 50 countries, TCS has a significant impact worldwide. It can efficiently serve clients across a wide range of industries and locations thanks to its large network of delivery facilities and offices.Tcs fundamental analysis also looks great as per above mentioned.

Strong Brand Reputation: TCS has over the years developed a strong brand reputation for providing top-notch IT services and solutions. This reputation draws customers, encourages customer loyalty, and helps in gaining new business.

Relations with Clients: TCS has a number of long-standing relationships with clients, several of whom are Fortune 500 businesses. These connections are based on mutual trust, subject-matter expertise, and in-depth knowledge of clients’ industries.

Talent Pool: TCS has access to a significant staff of highly qualified IT professionals. The organisation can create creative solutions and quickly adjust to shifting technological trends because to this talent resource.

Research and Development: TCS makes large investments in R&D to promote innovation and be on the cutting edge of new technology. TCS is able to provide innovative solutions to its clients thanks to its innovation capability.

Diversified Service Portfolio: TCS provides a wide range of services, including infrastructure services, business process outsourcing, application development, and IT consulting. The corporation is less susceptible to economic economic downturns in any one industry because to its diversification.

Cost efficiency: TCS has a competitive advantage related to its cost-effective delivery approach and operational efficiency. In comparison to many of its competitors, the company delivers services at a reduced cost by utilising its global delivery centres.

Data and Analytics Capabilities: TCS is a leader in data analytics and has successfully tapped into the power of big data to offer clients insightful information that will aid in making wise business decisions.

Expertise in Digital Transformation: In the current business environment, TCS is supporting digital transformation and has the knowledge to help clients on their digital journeys.

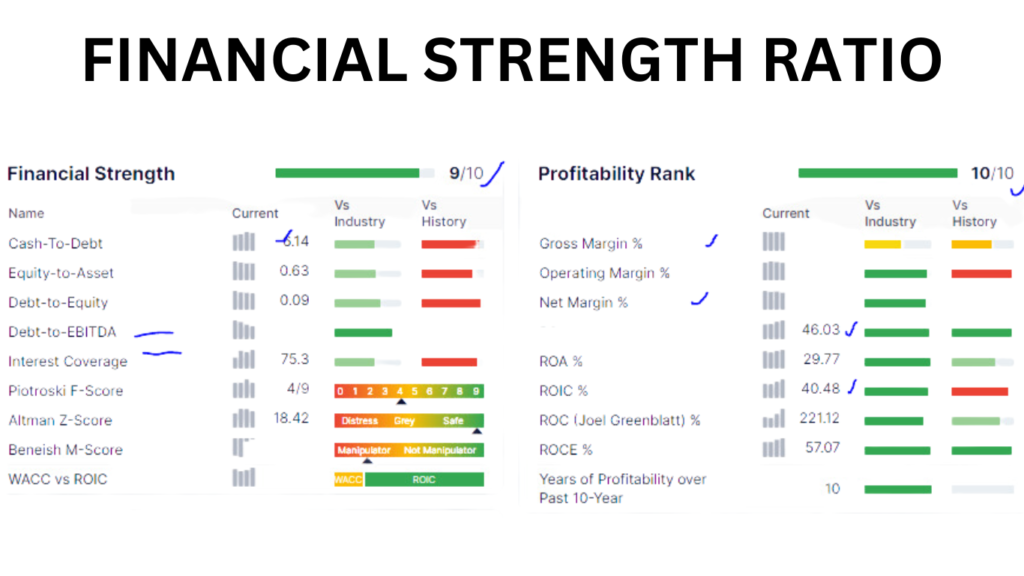

Strong Financial Position: TCS maintains a sound financial position with enough cash on hand and steady profitability, which gives it stability and freedom to explore expansion opportunities.

In summary, tcs fundamental analysis has a sizable economic moat that is based on its international reach, powerful brand, excellent client connections, skilled workforce, creativity, and variety of service offerings. These advantages have helped it maintain its dominance in the IT services sector, making it a tough and persistent competitor in the market.

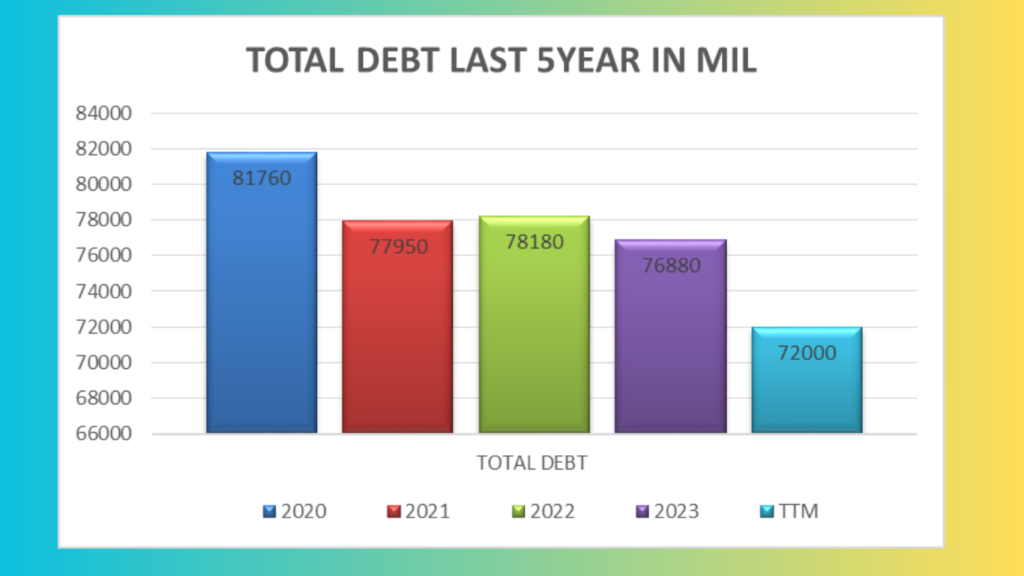

Financial Strength Ratio & Breakdowns of Netincome , Balance Sheet & Cashflow

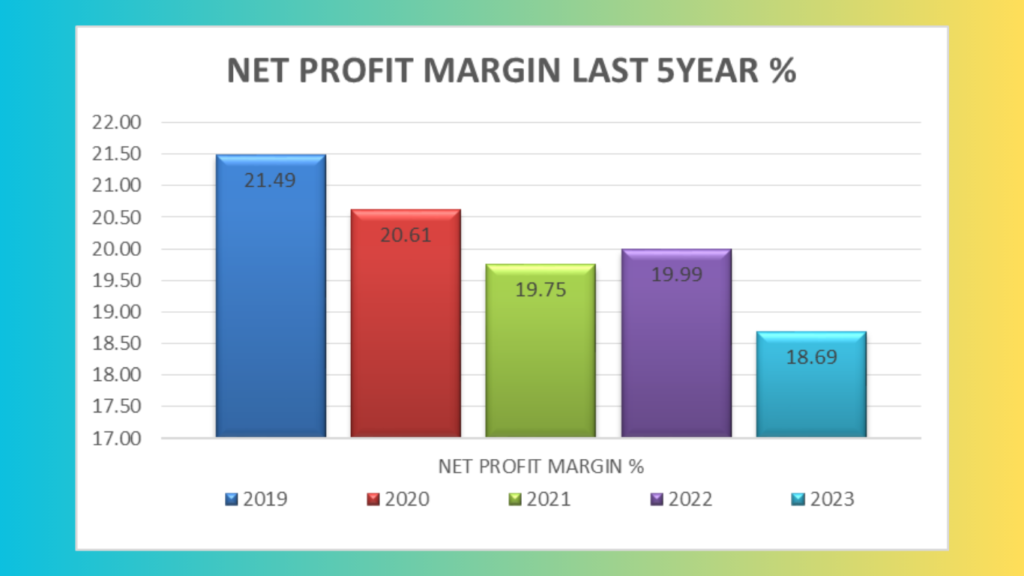

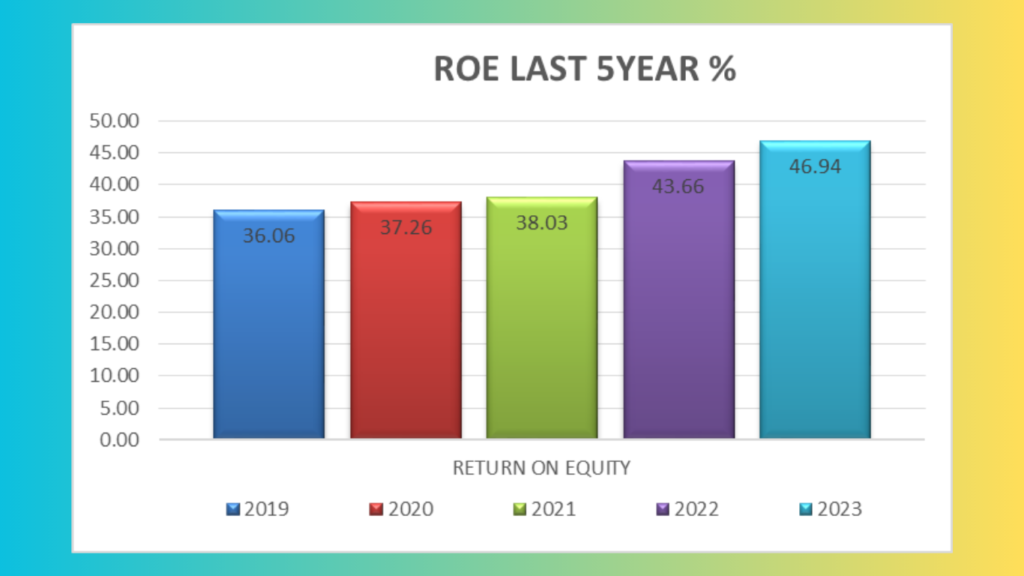

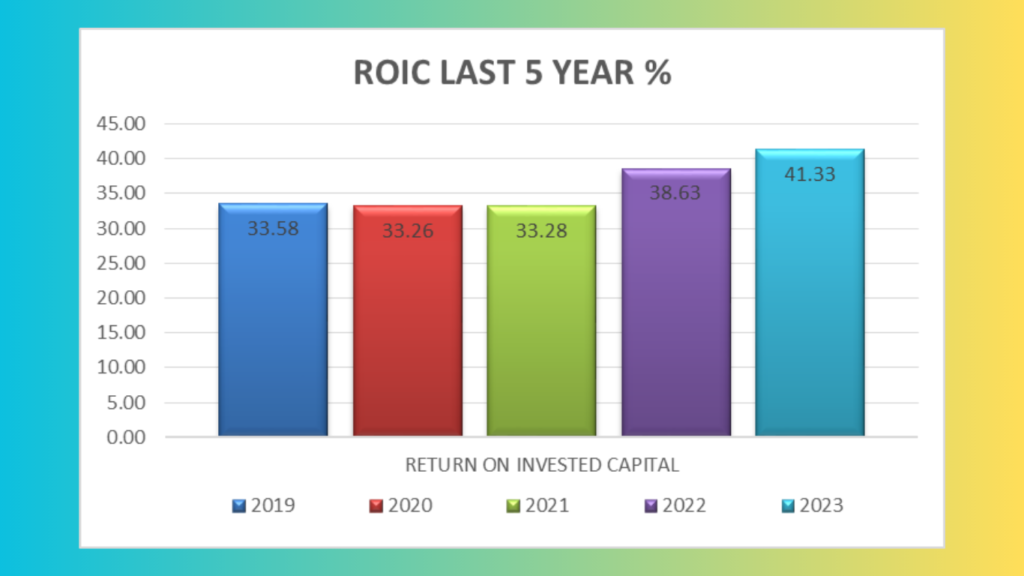

STEP 5: Company Margins

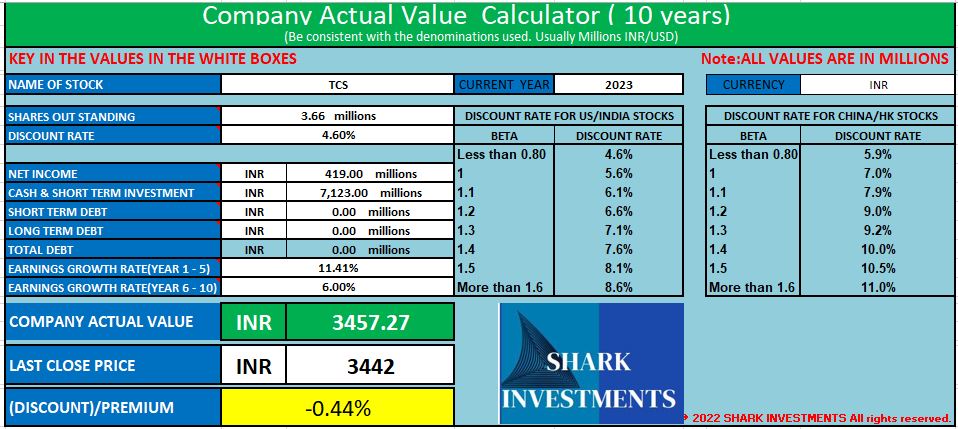

STEP 6: Company Actual Value

STEP 7: Price is Below or Near Intrinsic Value

STEP 8: Is it a Great Point of Entry

As per Above technical analysis, TCS fundamental analysis and tcs share price is trading at fair intrinic value. now reaches to a first entry level and grab this great opportunity.

Shark Investments Intrinsic value = 3457Rs

Other Financial Intrinsicvalue is = 3510 and 3600 ( Average = 3555)

Final Average of three Intrinsic value =3457 – 3555 Rs Inbetween we can buy this stock but as per shark investments, present selling discount. grab this great deal.

The three Entry Levels as per technical analsis by sharkinvestments:

1st Entry : 3440 Rs

2nd Entry : 3350Rs

3rd Entry : 3200 Rs.

STEP 9: Final Note

TCS Fundamental Analysis Overview: According to Shark Investments’ 10-step analysis, TCS fundamental analysis (Tata Consultancy Services) has solid fundamentals. Additionally, it satisfies technological standards and presents investors with an attractive entry point. Between 3457 and 3555 is the projected intrinsic value range for TCS.

Tcs Fundamental Analysis debt structre is almost zero and debt servicing ratio only 1.7%. we want to invest for like this comapnies.

Why TCS fundamental analysis Stands Out: As a reputable blue-chip firm, TCS is an excellent choice for investors. With sustained growth in revenue, net income, and operating cash flow over the previous five years, its financial health is excellent. Importantly, TCS has maintained a structure that is essentially debt-free, which is an extraordinary financial strength.

Additionally, Tcs is a well-known blue-chip stock in India. This prestigious certification is only given to businesses who have a track record of continuous performance, making them solid picks for long-term investors looking for sustainable profits.

TCS share price offers an appealing long-term investment opportunity, and this has been supported by excellent financial signs. TCS might be a pillar in a well-diversified investment portfolio due to its strong fundamentals, low debt, competitive advantages, and alignment with intrinsic value. Don’t let this great opportunity pass you by; add TCS as a smart addition to your long-term investing plan.

you can read this article’s as well.

- what is options trading?

- Future and options trading?

- How to select stocks for intraday

- Best indicator for option trading?

However, if you still have any questions about this topic, feel free to leave comments below.